Question 774579: Hi,

My name is Mawia. I have a question about auto loan interest. I would be glad if you could give me the formula that could help me understand how auto/car loan interest is calculated.

Thank you.!

Answer by KMST(5328)   (Show Source): (Show Source):

You can put this solution on YOUR website! Understanding and applying formulas are almost opposites.

I expect that people calculate the monthly payment (and total interest) for a car loan using a table to look for a factor, and then multiply the amount financed times that factor. Or maybe the use some sort of computer program. If you have Microsoft Excel in the computer you use, you can use the function PMT (payment) to calculate the monthly payment amount.

The total interest paid would be the total of all the payments minus the amount financed.

None of that requires any understanding, or any knowledge of math

I could write a formula that would let you calculate the monthly payment too. Using a formula would require a little knowledge of math, but would not really add to the understanding.

Understanding of the way financing works, and knowledge of math (up to geometric sequences) would let you deduce the formula, and understand how it is calculated.

For lack of time, I will give you a formula now, and I will add an explanation later.

L is the initial loaned amount,

I is the annual interest as a decimal (such as 0.06 for 6%),

the interest is compounded monthly,

payments are expected at the end of each month, and

N is the number of payments.

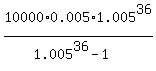

For example, for $10,000 financed at 6% anual interest (compounded monthly), for 36 payments (3 years), you would have

, ,  , ,  , ,  and and

payment=$ =$304.22 =$304.22

NOTES:

In practice, you may pay some extra money some months, you may pay a little early some months, and even pay a little late other months. The bank will adjust the balance before your last payment to reflect that.

Interest can be compounded monthly, daily, or continuously.

It is easier to compound monthly and calculate interest based on balance defined a certain way (maybe average daily balance).

WHERE THE FORMULA COMES FROM:

For practical purposes, you can assume that at the end of each month (and at the same time), interest will be added (interest compounded monthly), and a fixed minimum payment will be made.

Minimum monthly payment can be calculated that way.

Each month, the prior balance,  will be increased by a month worth of interest, will be increased by a month worth of interest,  , maxing the balance grow to , maxing the balance grow to

= balance at the start = balance at the start

= fixed monthly payment = fixed monthly payment

At the end of the first month, the balance increases by a factor of  , ,

and immediately decreases by an amount  , to a balance of , to a balance of

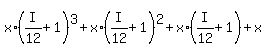

At the end of the second month, the same thing happens, and the balance is

At the end of the third month, the same thing happens, and the balance is

And the story repeats itself each month.

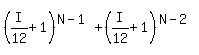

At the end of month  , the balance is , the balance is

... ...

That equation can be solved for x.

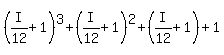

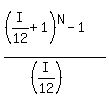

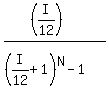

The long sum in square brackets is the sum of a geometric sequence and equals  , so , so

Dividing both sides of the equation by  , which is the same as multiplying times , which is the same as multiplying times  , we get , we get

or or

|

|

|