Question 388674: I need your help to write a formula for this question:

A single taxpayer uses a tax rate schedule to calculate the amount of tax to pay on a federal income tax return. If the tax payer has an adjusted income over $23,350, then the taxpayer must pay $3,502 plus 28% of any amount over $23,350. If the amount of adjusted income written as A and the tax if T, write the formula to find the tax.

Thank you for your help I really appreciate it!

Found 2 solutions by jim_thompson5910, mananth:

Answer by jim_thompson5910(35256)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's assume that the adjusted income is over $23,350

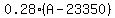

So because of this assumption, this means that "the taxpayer must pay $3,502 plus 28% of any amount over $23,350". What this means is that the tax payer is guaranteed to pay $3,502. So this means that the tax so far is  . Then the payer is expected to pay 28% of what's over $23,350. So you must add . Then the payer is expected to pay 28% of what's over $23,350. So you must add  because because  is the "amount over $23,350" and 0.28 is the decimal form of 28% is the "amount over $23,350" and 0.28 is the decimal form of 28%

So the tax formula is

Ex: Say that the payer earns $25,000. This means that s/he will pay  dollars in taxes. dollars in taxes.

If you need more help, email me at jim_thompson5910@hotmail.com

Also, feel free to check out my tutoring website

Jim

Answer by mananth(16946)   (Show Source): (Show Source):

You can put this solution on YOUR website! A single taxpayer uses a tax rate schedule to calculate the amount of tax to pay on a federal income tax return. If the tax payer has an adjusted income over $23,350, then the taxpayer must pay $3,502 plus 28% of any amount over $23,350. If the amount of adjusted income written as A and the tax if T, write the formula to find the tax.

...

T= 3,502+0.28(A-23,350)

|

|

|