Question 144647This question is from textbook PRACTICAL BUSINESS MATH PROCEDURES

: PLEASE HELP ME WITH THIS QUESTION: THANKS

ON JULY 26,2003, THE MINNEAPOLIS STAR TRIBUNE QUOTED AN EXECUTIVE VICE PRESIDENT AT ABN AMRO SAYING THAT 10% DOWN PAYMENTS HAD BECOME COMMON. FOR MOST CONVENTIONAL LOANS, A DOWN PAYMENT OF LESS THAN 20% MEANS BUYERS MUST PURCHASE PRIVATE MORTGAGE INSURANCE (PMI). DAVE MARVIN WANTS TO AVOID STHE PMI AND HAS $30,000 FOR A DOWN PAYMENT. A LOCAL BANK IS OFFERING 7% ON A FIXED 30 YEAR MORTGAGE. (A)WHAT IS THE MOST DAVE WILL BE ABLE TO PAY FOR A HOME? (B) WHAT WOULD BE HIS MONTLY PAYMENT?

This question is from textbook PRACTICAL BUSINESS MATH PROCEDURES

Answer by solver91311(24713)   (Show Source): (Show Source):

You can put this solution on YOUR website! Solve  to get the maximum total purchase price that Dave can pay without paying PMI. to get the maximum total purchase price that Dave can pay without paying PMI.

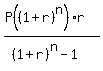

Calculate:  , where P is the principal amount of the loan (total purchase price minus down payment: 150,000 from the first part of the problem minus 30,000 is 120,000), n is the number of payment periods (monthly payments for 30 years: 30 * 12 = 360), r is the interest rate PER PERIOD (0.07/12=0.00583). , where P is the principal amount of the loan (total purchase price minus down payment: 150,000 from the first part of the problem minus 30,000 is 120,000), n is the number of payment periods (monthly payments for 30 years: 30 * 12 = 360), r is the interest rate PER PERIOD (0.07/12=0.00583).

Or save yourself some serious calculator button pushing. Open an Excel worksheet and type in the following: =pmt(.00583,360,120000)

Once you have typed it in, hit enter, you will get the monthly payment as a negative number (negative because it is presumeably coming OUT of your (or Dave's) pocket). Don't forget to remind Dave that this amount is only Principal and Interest -- he is also responsible for property tax and fire insurance.

|

|

|