|

Question 1210404: You can afford a $200 per month car payment. You've found a 3 year loan at 4% interest. How big of a loan can you afford?

Answer by ikleyn(52900)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

You can afford a $200 per month car payment. You've found a 3 year loan at 4% interest.

How big of a loan can you afford?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

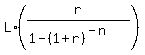

Use the standard formula for the monthly payment for a loan

M =  where L is the loan amount; r =

where L is the loan amount; r =  is the effective interest rate per month;

n is the number of payments (same as the number of months); M is the monthly payment.

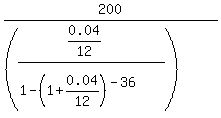

From this formula, the expression for the maximum loan is

L = is the effective interest rate per month;

n is the number of payments (same as the number of months); M is the monthly payment.

From this formula, the expression for the maximum loan is

L =  .

In this problem M = $200; r = .

In this problem M = $200; r =  , n = 3*12 = 36 monthly payments.

Substitute these values into the formula and get for the maximum loan amount

L = , n = 3*12 = 36 monthly payments.

Substitute these values into the formula and get for the maximum loan amount

L =  = $6,774.15.

ANSWER. The maximum loan amount is $6774.15. = $6,774.15.

ANSWER. The maximum loan amount is $6774.15.

Solved.

---------------------------

In such calculations, it is important to avoid intermediate rounding.

Rounding can be done at the end, only.

Intermediate rounding is PROHIBITED, since it leads to wrong answer.

Also, a calculator should provide the necessary precision.

I use MS Excel in my computer. It works with 15 decimals in mantissa

and provides the necessary precision.

I simply copy-paste my numerical formula into Excel spreadsheet and get the answer in one click.

Many standard online calculators provide the necessary precision.

You may use them to check my/your calculations.

//////////////////////////////

- - - - - added for your better understanding - - - - -

Notice that the full payment in 3 years in this problem is 3*12*200 = 7200 dollars.

It does not contradict to my answer, since the outpayment for the loan ($7200 in this case)

is always greater than the loaned amount ($6774.15).

The difference is what the financial company earns on this loan.

//////////////// INTERESTING and useful to know ////////////////

If you request an AI with this assignment, there is non-zero probability

that the AI will produce incorrect answer.

For example, today, Sept.29, 2025, I submitted this problem to the Google AI called "Overview".

It produced incorrect answer "A loan of approximately $6756 can be afforded. "

Compare with my correct answer $6,774.15.

At the end of their solution, they say that their value is approximate, so this excuses them.

But in banking calculations and in solving school problems, where the answer should match precisely,

such a discrepancy is  . .

This discrepancy is a consequence of the fact that their calculation procedure is DEFECTIVE.

I observed similar discrepancy in many their solved problems in Finance

(more than in 10 cases and more than in 20), so it happens REGULARLY.

Many times I pointed them to this their deficiency, but it looks like

they do not understand the problem - so they still did not fix it,  . .

Below is their output for documentation purposes.

///////////////// AI output START ////////////////

Loan Affordability Calculation

The maximum loan amount that can be afforded is determined by calculating the present value of an annuity,

where the monthly payment is the annuity payment.

Step-by-step Solution

1. Identify the given values:

• Monthly payment, $PMT = \$200$.

• Annual interest rate, $r_{annual} = 4\%$.

• Loan term, $t = 3 \text{ years}$.

2. Calculate the monthly interest rate:

• The monthly interest rate, $r_{monthly}$, is found by dividing the annual interest rate by $12$:

$r_{monthly} = \frac{r_{annual}}{12} = \frac{0.04}{12} = 0.003333$.

1. Calculate the total number of payments:

• The total number of payments, $n$, is found by multiplying the loan term in years by $12$:

$n = t \times 12 = 3 \times 12 = 36 \text{ payments}$.

1. Apply the present value of an annuity formula:

• The present value of an annuity, $PV$, which represents the maximum loan amount, is calculated using the formula:

$PV = PMT \times \frac{1 - (1 + r_{monthly})^{-n}}{r_{monthly}}$.

• Substitute the calculated values into the formula:

$PV = 200 \times \frac{1 - (1 + 0.003333)^{-36}}{0.003333}$.

• Calculate the term $(1 + 0.003333)^{-36}$:

$(1.003333)^{-36} \approx 0.8874$.

• Substitute this value back into the formula:

$PV = 200 \times \frac{1 - 0.8874}{0.003333}$.

• Perform the subtraction in the numerator:

$PV = 200 \times \frac{0.1126}{0.003333}$.

• Perform the division:

$PV = 200 \times 33.78$.

• Perform the final multiplication:

$PV \approx \$6756$.

Final Answer

A loan of approximately $\$6756$ can be afforded.

AI responses may include mistakes.

///////////////// AI output END ////////////////

The link to their AI solution is

https://www.google.com/search?q=You+can+afford+a+%24200+per+month+car+payment.+You%27ve+found+a+3+year+loan+at+4%25+interest.+How+big+of+a+loan+can+you+afford%3F&rlz=1C1CHBF_enUS1071US1071&oq=You+can+afford+a+%24200+per+month+car+payment.+You%27ve+found+a+3+year+loan+at+4%25+interest.+How+big+of+a+loan+can+you+afford%3F&gs_lcrp=EgZjaHJvbWUyBggAEEUYOTIHCAEQIRiPAtIBCTIwMDRqMGoxNagCCLACAfEFUQI36plXivjxBVECN-qZV4r4&sourceid=chrome&ie=UTF-8&zx=1759205570148&no_sw_cr=1

X X X X X X X X X X X X X X X X X X X X X

Come again to this forum soon to learn something new

or to get a precise solution in the future,

with complete and comprehensive explanations.

|

|

|

| |