|

Question 1207547: Joshua deposited $3560.00 at the beginning of every 6 months for 11 years into a fund paying 3.5% compounded semi-annually. Fourteen years after the first deposit, he then converted the existing balance into an annuity due paying him equal annual payments for 22 years. If interest for the annuity due is 5% compounded annually, what is the size of the annual payment?

Answer by ikleyn(52889)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Joshua deposited $3560.00 at the beginning of every 6 months for 11 years into a fund

paying 3.5% compounded semi-annually. Fourteen years after the first deposit,

he then converted the existing balance into an annuity due paying him equal annual payments

for 22 years. If interest for the annuity due is 5% compounded annually,

what is the size of the annual payment?

~~~~~~~~~~~~~~~~~~~~~

First 11 years, the account accumulates money as annuity-due saving plan, which is deposited

$3560 at the beginning of each 6 months.

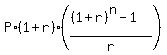

Use the standard formula for the future value at the end of this 11-years time period

FV =  , (1)

where FV is the future value of the account; P is the semi-annual payment (deposit)

at the beginning of each payment period; r is the semi-annual effective percentage

yield presented as a decimal; n is the number of deposits (= the number of years

multiplied by 2, or n= 11*2 = 22, in this case).

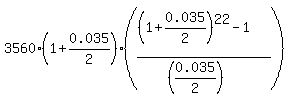

Under the given conditions, P = 3560; r = 0.035/2; n = 11*4 = 44.

So, according to the formula (1), the future value in 11 years is

FV = , (1)

where FV is the future value of the account; P is the semi-annual payment (deposit)

at the beginning of each payment period; r is the semi-annual effective percentage

yield presented as a decimal; n is the number of deposits (= the number of years

multiplied by 2, or n= 11*2 = 22, in this case).

Under the given conditions, P = 3560; r = 0.035/2; n = 11*4 = 44.

So, according to the formula (1), the future value in 11 years is

FV =  = $96193.53 (rounded). (2)

Two years after that, on years 12 and 13, the deposits were stopped;

but the amount is still compounded semi-annually; so, at the end of the 13-th year,

there ae = $96193.53 (rounded). (2)

Two years after that, on years 12 and 13, the deposits were stopped;

but the amount is still compounded semi-annually; so, at the end of the 13-th year,

there ae  = 103105.90 dollars on the account.

Now the account is converted and works as the sinking fund,

paying out for 22 years at the beginning of each year.

The formula connecting starting amount of $103105.90 and the annual payouts W is

103105.90 = = 103105.90 dollars on the account.

Now the account is converted and works as the sinking fund,

paying out for 22 years at the beginning of each year.

The formula connecting starting amount of $103105.90 and the annual payouts W is

103105.90 =  . (3)

In this formula, calculate the factor separately . (3)

In this formula, calculate the factor separately

= 13.82115271. (4)

Now from equation (3),

W = = 13.82115271. (4)

Now from equation (3),

W =  = 7460 dollars.

At this point, the solution is complete and the answer is obtained.

ANSWER. The size of the annual payment is 7460 dollars. = 7460 dollars.

At this point, the solution is complete and the answer is obtained.

ANSWER. The size of the annual payment is 7460 dollars.

Solved.

---------------

On annuity saving plans and sinking funds, see my lessons in this site

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Finding present value of an annuity, or an equivalent amount in today's dollars

- Withdrawing a certain amount of money periodically from a compounded saving account

From this lessons, learn the subject once and for all.

|

|

|

| |