Question 1207543: Suppose $726.56 is deposited at the end of every six months into an account earning 6.45% compounded semi-annually. If the balance in the account four years after the last deposit is to be $31 300.00, how many deposits are needed?

Answer by ikleyn(52915)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Suppose $726.56 is deposited at the end of every six months into an account earning 6.45%

compounded semi-annually. If the balance in the account four years after the last deposit

is to be $31 300.00, how many deposits are needed?

~~~~~~~~~~~~~~~~

Use the formula for an Ordinary Annuity saving account compounded semi-annually

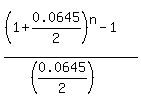

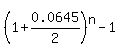

FV =  where FV is the future value, P is the payment at the end of every 6 months;

r is the interest rate per year expressed as decimal,

n is the number of semi-annual deposits.

So, we need to find " n " from this equation

where FV is the future value, P is the payment at the end of every 6 months;

r is the interest rate per year expressed as decimal,

n is the number of semi-annual deposits.

So, we need to find " n " from this equation

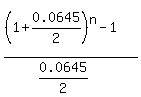

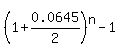

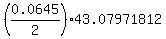

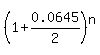

= =  = =  , which is the same as , which is the same as

= 43.07971812, = 43.07971812,

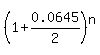

= =  , ,

= 1.389320909, = 1.389320909,

= 1+1.389320909. = 1+1.389320909.

= 2.389320909.

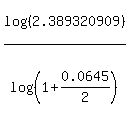

Take logarithm base 10 of both sides

n*log(1+0.0645/12) = log(2.389320909)

and calculate

n = = 2.389320909.

Take logarithm base 10 of both sides

n*log(1+0.0645/12) = log(2.389320909)

and calculate

n =  = 27.44 time periods.

Round it to the closest greater integer, which is 28 semi-annual periods,

in order for the bank would be in position to compete the last compounding.

28 semi-annual periods is the same as 14 years.

ANSWER. 14 years. = 27.44 time periods.

Round it to the closest greater integer, which is 28 semi-annual periods,

in order for the bank would be in position to compete the last compounding.

28 semi-annual periods is the same as 14 years.

ANSWER. 14 years.

Solved.

|

|

|