|

Question 1206656: A loan of $ 10,000 is amortized by equal annual payments for 30 years at an effective annual interest rate of 8 %. Determine the year in which the interest portion of the payment is most nearly equal to one-third of the payment.

The year that the interest portion of payment is most nearly equal to one-third of the payment =

Answer by ikleyn(52790)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

1206656

A loan of $ 10,000 is amortized by equal annual payments for 30 years

at an effective annual interest rate of 8 %. Determine the year in which

the interest portion of the payment is most nearly equal to one-third of the payment.

The year that the interest portion of payment is most nearly equal to one-third of the payment =

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The solution is in three steps. First, I determine the annual payment.

Then I determine a series of interest portion of the annual payments.

Then I look which of the interest portions is most nearly equal to one-third of the payment.

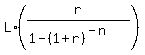

Use the formula for the annual payment for a loan

Y =  where L is the loan amount; r = 0.08 is the annual interest rate;

n is the number of payments (in this problem it the same as the number of years);

Y is the annual payment.

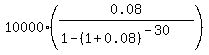

In this problem P = $10,000; r = 0.08, n = 30 annual payments.

Substitute these values into the formula and get for monthly payment

Y =

where L is the loan amount; r = 0.08 is the annual interest rate;

n is the number of payments (in this problem it the same as the number of years);

Y is the annual payment.

In this problem P = $10,000; r = 0.08, n = 30 annual payments.

Substitute these values into the formula and get for monthly payment

Y =  = $888.27.

Thus, the annual payment is $888.27.

(1/3) of the annual payment is 888.27/3, or 296.09 dollars.

To determine the interest portions of annual payments, I use Excel function IPMT.

For the description of this function, its parameters and syntaxis, see these sources

wording/text description

https://www.wallstreetprep.com/knowledge/ipmt-function/

Youtube videos

https://www.youtube.com/watch?v=xZq4RNqE7ts

https://www.youtube.com/watch?v=bni0l75lc-8

The table of results is shown below

Year Interest part the difference

of the annual between column 2

payment and 296.09 dollars

----------------------------------------------------

1 800.00 503.91

2 792.94 496.85

3 785.31 489.22

4 777.07 480.98

5 768.18 472.09

6 758.57 462.48

7 748.19 452.10

8 736.99 440.90

9 724.88 428.79

10 711.81 415.72

11 697.70 401.61

12 682.45 386.36

13 665.98 369.89

14 648.20 352.11

15 629.00 332.91

16 608.25 312.16

17 585.85 289.76

18 561.66 265.57

19 535.53 239.44

20 507.31 211.22

21 476.83 180.74

22 443.92 147.83

23 408.37 112.28

24 369.97 73.88

25 328.51 32.42

26 283.73 12.36 <<<---===

27 235.37 60.72

28 183.13 112.96

29 126.72 169.37

30 65.80 230.29

The minimum value in the third column is marked by <<<---===.

It is 26-th year payment.

ANSWER. The minimum difference is in the 26-th year payment. = $888.27.

Thus, the annual payment is $888.27.

(1/3) of the annual payment is 888.27/3, or 296.09 dollars.

To determine the interest portions of annual payments, I use Excel function IPMT.

For the description of this function, its parameters and syntaxis, see these sources

wording/text description

https://www.wallstreetprep.com/knowledge/ipmt-function/

Youtube videos

https://www.youtube.com/watch?v=xZq4RNqE7ts

https://www.youtube.com/watch?v=bni0l75lc-8

The table of results is shown below

Year Interest part the difference

of the annual between column 2

payment and 296.09 dollars

----------------------------------------------------

1 800.00 503.91

2 792.94 496.85

3 785.31 489.22

4 777.07 480.98

5 768.18 472.09

6 758.57 462.48

7 748.19 452.10

8 736.99 440.90

9 724.88 428.79

10 711.81 415.72

11 697.70 401.61

12 682.45 386.36

13 665.98 369.89

14 648.20 352.11

15 629.00 332.91

16 608.25 312.16

17 585.85 289.76

18 561.66 265.57

19 535.53 239.44

20 507.31 211.22

21 476.83 180.74

22 443.92 147.83

23 408.37 112.28

24 369.97 73.88

25 328.51 32.42

26 283.73 12.36 <<<---===

27 235.37 60.72

28 183.13 112.96

29 126.72 169.37

30 65.80 230.29

The minimum value in the third column is marked by <<<---===.

It is 26-th year payment.

ANSWER. The minimum difference is in the 26-th year payment.

Solved.

|

|

|

| |