|

Question 1205675: Every week you put $10 in an investment that pays 10.4% interest, compounded weekly. After 35 years how much would you put into the investment?

Found 3 solutions by Theo, ikleyn, math_tutor2020:

Answer by Theo(13342)   (Show Source): (Show Source):

You can put this solution on YOUR website! use the calculator at to solve this

inputs are:

present value = 0

future value = 0

number of time periods are years * 52 weeks per year = 1820 weeks.

interest rate per time period = 10.45 / 52 = .2009615385% per week.

payment per week = dollars (entered as negative because it's money going out).

payment are made at the end of each time period.

click on future value to get the value of the investment at the end of the 35 year investment period = 1870211.44.

that's what you get back from the investment.

what you put into the investment is 1820 * 10 = 18,200 dollars.

the results of the financial analysis through the calculator are shown below.

let me know if you have any questionx or need further information.

theo

Answer by ikleyn(52897)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Every week you put $10 in an investment that pays 10.4% interest, compounded weekly.

After 35 years how much would you put into the investment?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In his solution, @Theo mistakenly used the annual interest rate 0.1045,

while the given value of the annual interest rate in this problem is 0.104.

I came to show you calculations/solution for the given value of the annual interest.

Although the problem does not say it explicitly, I will assume that the investment

is made at the end of each week.

Then it is a classic ordinary annuity saving plan.

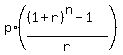

The formula for the Ordinary Annuity saving plan is

f =  ,

f is the future value

p is the weekly payment

r is the interest rate per time period

n is the number of time periods.

In your problem:

time periods are weeks.

p = 10 dollars

r = 0.104/52 interest per week

n = 35 * 52 = 1820 weeks (counting 52 weeks in the year)

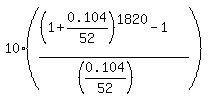

formula becomes f = ,

f is the future value

p is the weekly payment

r is the interest rate per time period

n is the number of time periods.

In your problem:

time periods are weeks.

p = 10 dollars

r = 0.104/52 interest per week

n = 35 * 52 = 1820 weeks (counting 52 weeks in the year)

formula becomes f =  = 184768.09.

You will have $184768.09 in your saving account in 35 years.

Interesting, that your total direct investment will be only $10*52*35 = $18200.

The rest is what the account will earn due to compounding. = 184768.09.

You will have $184768.09 in your saving account in 35 years.

Interesting, that your total direct investment will be only $10*52*35 = $18200.

The rest is what the account will earn due to compounding.

Solved.

---------------------

On Ordinary Annuity saving plans see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about this subject, in clear and compact form.

When you learn from these lessons, you will be able to do similar calculations in semi-automatic mode.

/////////////////////

To make such complicated calculations as they are in this problem,

you should have/use an appropriate calculator for such long formulas.

Ideal choice is MS Excel, if you have it in your computer.

Then you write a formula in a text editor, copy-paste it

into an Excel work-sheet cell and click "enter" - the result is ready

instantaneously.

If you have no MS Excel in your computer, you may find similar

free of charge calculators in the Internet. One such calculator is

www.desmos.com/calculator

It allows you to do the same thing: you write a formula in a text editor,

copy-paste it into this calculator and click "enter" - the result is ready

instantaneously.

Answer by math_tutor2020(3817)   (Show Source): (Show Source):

You can put this solution on YOUR website!

Answer: $18,200

The calculation would be 10*35*52 = 18200 where the 52 represents 52 weeks in a year (roughly).

Notice the question asks "how much would you put into the investment" and not "how much is the investment worth after 35 years".

If it was the second option, then you would use the future value formula that tutor ikleyn has posted.

|

|

|

| |