Question 1201866: Reggie has just taken over management of a family business. He wants to make sure that it makes financial sense to keep the business going. He could sell the building today for $610,000. Keeping the business going will require a $60,000 renovation now and will yield an annual profit of $72,000 for the next 25 years (for simplicity assume these occur at year end, beginning one year from now). The discount/interest rate is 6%. What are the NPV and IRR of this decision?

Found 2 solutions by Theo, ikleyn:

Answer by Theo(13342)   (Show Source): (Show Source):

You can put this solution on YOUR website! he could sell the building tody for 610,000.

to keep the business runing, he would have to spend 60,000 now and will yield an annual profit of 72,000 for the next 25 years.

the discount interest rate if 6%.

all profit is assumed to occur at the end of each year.

i used excel to create the cash flow and the NPV (net present value) and the IRR (internal rate of return).

the results are shown below:

plan A was keeping the business going.

plan B wass to sell the building (and presumably leaving the business) for $610,000.

at 6% discount rate, the results showed that keeping the business for 25 years gave a higher NPV than selling the building and getting out of the business.

the internal rate of return of plan A, by itself, was 120% over the 25 year period.

the internl rate of return of plan A minus plan B was 9.68%, rounded to 2 decimal places.

since plan A NPV was greater than plan B at 6%, it is reasonable that the internal rate of return of plan A minus plan B was greater than 6%.

if you are looking at the results of the decision, you are probably looking at the results of plan A minus plan B comparison.

NPV plan A minus plan B comparison is $250,401.64 in favor of plan A.

the internal rate of return of that decision is 9.68%, rounded to two decimal places.

plan A (keeping the business going) is the winner, as far as i can tell.

Answer by ikleyn(52852)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Reggie has just taken over management of a family business.

He wants to make sure that it makes financial sense to keep the business going.

He could sell the building today for $610,000.

Keeping the business going will require a $60,000 renovation now and will yield

an annual profit of $72,000 for the next 25 years

(for simplicity assume these occur at year end, beginning one year from now).

The  interest rate is 6%. What are the NPV and IRR of this decision? interest rate is 6%. What are the NPV and IRR of this decision?

~~~~~~~~~~~~~~~~

NPV is the net present value.

In this problem, it is the difference of the present value of the given

ordinary annuity and the this year investment for renovation

NPV = PV - 60000 dollars.

For the present value PV of the annuity, use the standard formula

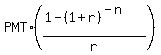

PV =  .

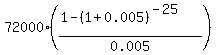

Here PMT = 72,000 dollars; r = 0.06/12 = 0.005; n= 25 years. So,

PV = .

Here PMT = 72,000 dollars; r = 0.06/12 = 0.005; n= 25 years. So,

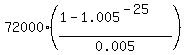

PV =  = =  = 1688085.94 dollars.

NPV = PV- 60000 = 1688085.94 - 60000 = 1,628,085.94 dollars.

You may compare it with $610,000 for selling the building now. = 1688085.94 dollars.

NPV = PV- 60000 = 1688085.94 - 60000 = 1,628,085.94 dollars.

You may compare it with $610,000 for selling the building now.

|

|

|