Question 1199132: Suppose you put $ 525 a month for retirement into an annuity earning 7% compounded monthly. If you need $ 350000 to retire, in how many years will you be able to retire?

Years =

Answer by ikleyn(52817)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Suppose you put $ 525 a month for retirement into an annuity earning 7% compounded monthly.

If you need $ 350000 to retire, in how many years will you be able to retire?

~~~~~~~~~~~~~~~~~

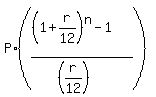

The formula for an Ordinary Annuity saving account compounded monthly is

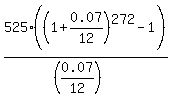

FV =  where FV is the future value, P is the annual payment at the end of each month,

r is the interest rate per year expressed as decimal,

n is the number of monthly deposits (of months).

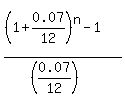

So, we need to find " n " from the equation

where FV is the future value, P is the annual payment at the end of each month,

r is the interest rate per year expressed as decimal,

n is the number of monthly deposits (of months).

So, we need to find " n " from the equation

= =  = =  = 666.667,

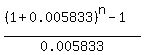

which is the same as = 666.667,

which is the same as

= 666.667.

Rewrite it in this form = 666.667.

Rewrite it in this form

= 0.005833*666.667, = 0.005833*666.667,

= 1 + 0.005833*666.667 = 4.88867.

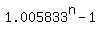

Take the logarithm base 10 of both sides

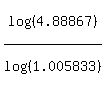

n*log(1.005833) = log(4.88867)

and calculate

n = = 1 + 0.005833*666.667 = 4.88867.

Take the logarithm base 10 of both sides

n*log(1.005833) = log(4.88867)

and calculate

n =  = 272.75 months = 273 months (rounded to the nearest greater integer value) = 22 years and 9 months. ANSWER

CHECK. = 272.75 months = 273 months (rounded to the nearest greater integer value) = 22 years and 9 months. ANSWER

CHECK.  = 350400, which is slightly greater than 350000; = 350400, which is slightly greater than 350000;

= 347846, which is slightly lesser than 350000.

ANSWER. 273 months is needed, or 22.75 years = 22 years and 9 months.

If to round to closest year, then 23 years is just enough; 22 years is not enough yet. = 347846, which is slightly lesser than 350000.

ANSWER. 273 months is needed, or 22.75 years = 22 years and 9 months.

If to round to closest year, then 23 years is just enough; 22 years is not enough yet.

Solved, checked, explained and completed.

-----------------------

On ordinary annuity saving plan, see my lessons in this site

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

Learn the subject from there.

|

|

|