Question 1193768: A P38,000 loan bears interest at 10% compounded semi-annually and is to be repaid in semi-annual payments of P2,000 each.

a. How many semi-annual payments must be the debtor make?

b. What smaller final payment should he make six months after the last payment of P2,000 is made?

Found 2 solutions by proyaop, ikleyn:

Answer by proyaop(69)   (Show Source): (Show Source):

You can put this solution on YOUR website! **a. Determine the Number of Semi-Annual Payments**

* **Find the effective semi-annual interest rate:**

* Semi-annual interest rate = (1 + Annual Interest Rate / Number of compounding periods per year)^(Number of compounding periods per year) - 1

* Semi-annual interest rate = (1 + 0.10 / 2)^(2) - 1

* Semi-annual interest rate = 0.0525 or 5.25%

* **Use a financial calculator or spreadsheet software (like Excel or Google Sheets) to determine the number of payments.**

* **In Excel, you can use the NPER function:**

* `=NPER(rate, pmt, pv, [fv], [type])`

* rate: Semi-annual interest rate (0.0525)

* pmt: Payment amount (-2000)

* pv: Present value (38000)

* fv: Future value (0, as the loan will be fully paid off)

* type: 0 for payments at the end of each period (default)

* This will give you the number of semi-annual payments required to repay the loan.

**b. Calculate the Smaller Final Payment**

1. **Calculate the remaining balance after the last full payment of P2,000:**

* This involves calculating the remaining balance after the number of full payments determined in part (a). You can use the financial calculator or spreadsheet functions like `FV` (future value) to calculate the remaining balance after these payments.

2. **Calculate the interest accrued on the remaining balance:**

* Multiply the remaining balance by the semi-annual interest rate.

3. **Calculate the final payment:**

* Final payment = Remaining balance + Interest accrued on the remaining balance

**Note:**

* This approach provides a general framework for solving this type of loan repayment problem.

* The specific calculations will require the use of financial tools or software.

Let me know if you'd like to explore the calculations using a specific financial calculator or spreadsheet software.

Answer by ikleyn(52776)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

A P38,000 loan bears interest at 10% compounded semi-annually and is to be repaid

in semi-annual payments of P2,000 each.

a. How many semi-annual payments must be the debtor make?

b. What smaller final payment should he make six months after the last payment

of P2,000 is made?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

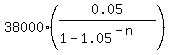

Use the standard formula for the semi-annual payment for a loan

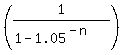

P =  ,

where L is the loan amount; r = ,

where L is the loan amount; r =  is the effective semi-annual compounding interest rate;

n is the number of payments; P is the semi-annual payment.

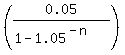

In this problem P = $2000; r = is the effective semi-annual compounding interest rate;

n is the number of payments; P is the semi-annual payment.

In this problem P = $2000; r =  = 0.05.

Substitute these values into the formula and get for semi-annual payment

2000 = = 0.05.

Substitute these values into the formula and get for semi-annual payment

2000 =  .

In this equation, n is the unknown: we should find n from this equation.

Simplify step by step .

In this equation, n is the unknown: we should find n from this equation.

Simplify step by step

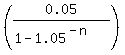

= =  ,

0.052631579 = ,

0.052631579 =  , ,

= =  ,

1.05263158 = ,

1.05263158 =  , ,

= =  ,

0.95 = ,

0.95 =  , ,

= 1 - 0.95, = 1 - 0.95,

= 0.05, = 0.05,

= 0.05,

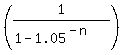

1.05^n = 1/0.05,

1.05^n = 20,

n*log(1.05) = log(20),

n = = 0.05,

1.05^n = 1/0.05,

1.05^n = 20,

n*log(1.05) = log(20),

n =  = 61.4.

So, 61 full semi-annual payments should be made of 2,000 each,

and then the last,62-th payment, should be made of the lesser amount.

ANSWER. 61 full semi-annual payments should be made of 2,000 each,

and then the last, 62-th payment, should be made of the lesser amount.

The total number of semi-annual payments is 62. = 61.4.

So, 61 full semi-annual payments should be made of 2,000 each,

and then the last,62-th payment, should be made of the lesser amount.

ANSWER. 61 full semi-annual payments should be made of 2,000 each,

and then the last, 62-th payment, should be made of the lesser amount.

The total number of semi-annual payments is 62.

Solved.

|

|

|