Question 1190593: A. Avery and their family currently pay $1300 in rent per month. They want to know how much they could borrow for a mortgage if they wanted to make monthly payments that are the same as their current rent.

1. One possible loan is a 30-year mortgage with a 3.48% APR. How much could Avery borrow? (Round down to the dollar.)

How much would they pay back over the life of the loan?

Found 2 solutions by CPhill, ikleyn:

Answer by CPhill(1987)   (Show Source): (Show Source):

You can put this solution on YOUR website! Here's how to calculate the loan amount and total payback:

**1. Loan Amount:**

We'll use the present value of an annuity formula, as the loan amount is the present value of the stream of future mortgage payments.

PV = PMT * [1 - (1 + r)^-n] / r

Where:

* PV = Present Value (Loan Amount - what we want to find)

* PMT = Monthly Payment ($1300)

* r = Monthly Interest Rate (3.48% annual / 12 months = 0.0348/12 = 0.0029)

* n = Number of Payments (30 years * 12 months = 360)

PV = 1300 * [1 - (1 + 0.0029)^-360] / 0.0029

PV = 1300 * [1 - 0.3733] / 0.0029

PV = 1300 * 0.6267 / 0.0029

PV = 1300 * 216.10

PV ≈ $280,930

Rounded down to the dollar, Avery could borrow approximately **$280,930**.

**2. Total Payback:**

Total Payback = Monthly Payment * Number of Payments

Total Payback = $1300 * 360

Total Payback = **$468,000**

Answer by ikleyn(52865)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Avery and their family currently pay $1300 in rent per month. They want to know how much they could borrow

for a mortgage if they wanted to make monthly payments that are the same as their current rent.

One possible loan is a 30-year mortgage with a 3.48% APR. How much could Avery borrow? (Round down to the dollar.)

How much would they pay back over the life of the loan?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Calculations in the post by @CPhill are not accurate.

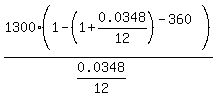

The formula, which should be used, is

PV =  .

Calculations should be done without making intermediate rounding.

Rounding is made at the end, ONLY.

The correct answer is 290,224.56 dollars, which can be rounded to $290,225. .

Calculations should be done without making intermediate rounding.

Rounding is made at the end, ONLY.

The correct answer is 290,224.56 dollars, which can be rounded to $290,225.

Solved.

------------------------------------------------

I used MS Excel in my computer, which works with 15 decimals after the decimal point,

providing a necessary precision.

It is equivalent to Google worksheet.

These are the best and the most appropriate calculators for such computing.

You write the formula in any text editor, copy-paste it into the spreadsheet cell and get the answer instantly.

|

|

|