Question 1184031: a local university is planning to invest $ 500,000 every 3 months in an investment which earns interest at the rate of 12 percent per year compounded quarterly. the first investment will be at the end of this current quarter. (a) to what sum will the investment grow at the end of 5 years? (b) how much interest will be earned during this period?

Answer by ikleyn(52772)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

a local university is planning to invest $ 500,000 every 3 months in an investment which earns interest at the rate

of 12 percent per year compounded quarterly. The first investment will be at the end of this current quarter.

(a) to what sum will the investment grow at the end of 5 years?

(b) how much interest will be earned during this period?

~~~~~~~~~~~~~~~~~~~~

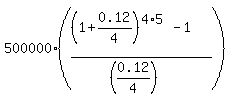

It is a classic Ordinary Annuity saving plan. The general formula is

FV =  , (1)

where FV is the future value of the account; P is the quarterly payment (deposit); r is the quarterly percentage yield

presented as a decimal; n is the number of deposits (= the number of years multiplied by 4, in this case).

Under the given conditions, P = 500000; r = 0.12/4; n = 4*5 = 20. So, according to the formula (1), you get at the end of the 5-th year

FV = , (1)

where FV is the future value of the account; P is the quarterly payment (deposit); r is the quarterly percentage yield

presented as a decimal; n is the number of deposits (= the number of years multiplied by 4, in this case).

Under the given conditions, P = 500000; r = 0.12/4; n = 4*5 = 20. So, according to the formula (1), you get at the end of the 5-th year

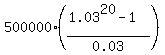

FV =  = =  = $ 13,435,187.

Note that the university deposits only 4*5*$500,000 = $ 10,000,000 in 5 years.

The rest is the interest, which the account earns/accumulates in 5 years. = $ 13,435,187.

Note that the university deposits only 4*5*$500,000 = $ 10,000,000 in 5 years.

The rest is the interest, which the account earns/accumulates in 5 years.

-----------------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about this subject, in clear and compact form.

When you learn from these lessons, you will be able to do similar calculations in semi-automatic mode.

|

|

|