Question 1183636: a person wishes to deposits $5000 per year in a savings account which earns interest of 8 percent per year compounded annually . assume the first deposit is made at the end of this current year and additional deposits at the end of each following year

a: to what sum will the investment grow at the time of the 10 deposit.

b: who much interest will be earned.

Answer by ikleyn(52756)   (Show Source): (Show Source):

You can put this solution on YOUR website! a person wishes to deposits $5000 per year in a savings account which earns interest of 8 percent per year compounded annually.

assume the first deposit is made at the end of this current year and additional deposits at the end of each following year

a: to what sum will the investment grow at the time of the 10 deposit.

b:  HOW much interest will be earned. HOW much interest will be earned.

~~~~~~~~~~~~~~~~~~~~~~~~~~~

It is a classic Ordinary Annuity saving plan. The general formula is

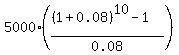

FV =  , (1)

where FV is the future value of the account; P is the annual payment (deposit); r is the annual percentage rate

presented as a decimal; n is the number of deposits (= the number of years, in this case).

Under the given conditions, P = 5000; r = 0.08; n = 10. So, according to the formula (1), you get at the end of the 10-th year

FV = , (1)

where FV is the future value of the account; P is the annual payment (deposit); r is the annual percentage rate

presented as a decimal; n is the number of deposits (= the number of years, in this case).

Under the given conditions, P = 5000; r = 0.08; n = 10. So, according to the formula (1), you get at the end of the 10-th year

FV =  = $72,432.81.

Note that the person deposits only 10*$5000 = $50,000. The rest is what the account earns/accumulates in 10 years. = $72,432.81.

Note that the person deposits only 10*$5000 = $50,000. The rest is what the account earns/accumulates in 10 years.

-----------------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about this subject, in clear and compact form.

When you learn from these lessons, you will be able to do similar calculations in semi-automatic mode.

|

|

|