.

Let me re-formulate the post to make the problem formulation correct, precise and clear, as it should be.

You want to be able to withdraw $45,000 from your account at the beginning of each year for 25 years after you retire.

You expect to retire in 30 years.

If your account earns 9% interest compounded yearly, how much will you need to deposit at the end of each year

until retirement to achieve your retirement goals?

Solution

The solution is in 2 steps.

Step 1

Step 1 is to determine what amount you need to have at your account after 30 years depositing to it

in order for to be able to withdraw $45,000 from your account at the beginning of each year for 25 years after you retire.

The general formula to calculate this amount is

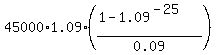

X =  .

In this case the withdrawal semi-annual rate is W = $45000, the annual compounding rate

is r = 0.09, p = 1 + 0.09 = 1.09, the number of payment periods is n = 25. So

X =

.

In this case the withdrawal semi-annual rate is W = $45000, the annual compounding rate

is r = 0.09, p = 1 + 0.09 = 1.09, the number of payment periods is n = 25. So

X =  = 481,797.53 dollars.

= 481,797.53 dollars.

Step 2

At this step we determine how big the annual deposit should be to provide this amount of $481,797.53 after 30 years of depositing.

This time it is classic Ordinary Annuity saving plan. The general formula is

FV =  ,

where FV is the future value of the account; P is annual payment (deposit); r is the annual percentage yield presented as a decimal;

n is the number of deposits (= the number of years, in this case).

From this formula, you get for the annual payment

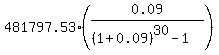

P =

,

where FV is the future value of the account; P is annual payment (deposit); r is the annual percentage yield presented as a decimal;

n is the number of deposits (= the number of years, in this case).

From this formula, you get for the annual payment

P =  . (1)

Under the given conditions, FV = $481,797.53; r = 0.09; n = 30. So, according to the formula (1), you get for the annual payment

P =

. (1)

Under the given conditions, FV = $481,797.53; r = 0.09; n = 30. So, according to the formula (1), you get for the annual payment

P =  = $3534.64.

So, your annual deposit should be $3534.64. ANSWER

ANSWER. To provide your goal, you need to deposit $3534.64 dollars annually at the end of each year during 30 years.

= $3534.64.

So, your annual deposit should be $3534.64. ANSWER

ANSWER. To provide your goal, you need to deposit $3534.64 dollars annually at the end of each year during 30 years.

Solved.

------------------

If you want to learn the theory of this financing and/or see other similar solved problems, look into my lessons in this site

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Withdrawing a certain amount of money periodically from a compounded saving account

- Miscellaneous problems on retirement plans

Happy learning !