.

It is a classic Ordinary Annuity saving plan. The general formula is

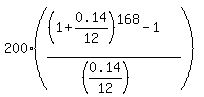

FV =  , (1)

where FV is the future value of the account; P is your monthly payment (deposit); r is the monthly percentage yield presented as a decimal;

n is the number of deposits (= the number of years multiplied by 12, in this case).

Under the given conditions, P = 200; r = 0.14/12; n = 12*14 = 168. So, according to the formula (1), you get at the end of the 14-th year

FV =

, (1)

where FV is the future value of the account; P is your monthly payment (deposit); r is the monthly percentage yield presented as a decimal;

n is the number of deposits (= the number of years multiplied by 12, in this case).

Under the given conditions, P = 200; r = 0.14/12; n = 12*14 = 168. So, according to the formula (1), you get at the end of the 14-th year

FV =  =

=  = $103187.

Note that you deposit only 12*14*$200 = $33600. The rest is what the account earns/accumulates in 14 years.

= $103187.

Note that you deposit only 12*14*$200 = $33600. The rest is what the account earns/accumulates in 14 years.

-----------------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.