Question 1120480: Jimmy opens a savings account with a $280 deposit at the beginning of the month. The account earns 4.3% annual interest compounded monthly. At the beginning of each subsequent month, Jimmy deposits an additional $280. How much will the account be worth at the end of 14 years? $

Found 3 solutions by ankor@dixie-net.com, MathTherapy, ikleyn:

Answer by ankor@dixie-net.com(22740)   (Show Source): (Show Source):

You can put this solution on YOUR website! Jimmy opens a savings account with a $280 deposit at the beginning of the month.

The account earns 4.3% annual interest compounded monthly.

At the beginning of each subsequent month, Jimmy deposits an additional $280.

How much will the account be worth at the end of 14 years? $

:

14 * 12 = 168 periods

:

The annuity formula:

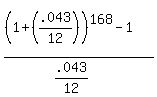

FV = 280

do the math

FV = 280(229.8985)

FV = $64,371.60

Answer by MathTherapy(10552)   (Show Source): (Show Source):

You can put this solution on YOUR website! Jimmy opens a savings account with a $280 deposit at the beginning of the month. The account earns 4.3% annual interest compounded monthly. At the beginning of each subsequent month, Jimmy deposits an additional $280. How much will the account be worth at the end of 14 years? $

You need to apply the formula for future value of an ANNUITY DUE, or:  , and , and

NOT the one for future value of an ORDINARY ANNUITY. This should yield:  , as opposed to $64,371.60. , as opposed to $64,371.60.

This is the difference between making payments, or depositing at the BEGINNING of a period, instead of at the end of the period.

For the above:

is: FUTURE VALUE of an ANNUITY DUE (Unknown, in this case) is: FUTURE VALUE of an ANNUITY DUE (Unknown, in this case)

PMT is: PERIODIC PAYMENT made ($280, in this case)

"i" is: ANNUAL Interest rate (4.3%, or .043, in this case)

m is: number of ANNUAL COMPOUNDING periods (12, in this case)

t is: Time, in years it takes to reach Future Value (14 years, in this case)

Answer by ikleyn(52781)   (Show Source): (Show Source):

|

|

|