Question 1099126: A person plans to invest a total of $220,000 in a money market account, a bond fund, an international stock fund, and a domestic stock fund. She wants 60% of her investment to be conservative (money market and bonds). She wants the amount in domestic stocks to be 4 times the amount in international stocks. Finally, she needs an annual return of $8,800. Assuming she gets annual returns of 2.5% on the money market account, 3.5% on the bond fund, 4% on the international stock fund, and 6% on the domestic stock fund, how much should she put in each investment?

The matrix work in this problem trips me up with how many steps there are, can you please help me solve this?

Answer by greenestamps(13209)   (Show Source): (Show Source):

You can put this solution on YOUR website!

I assume you are to solve this using Gauss-Jordan elimination....

There's no two ways about it: with the number of steps it takes to complete a Gauss-Jordan elimination, it is exasperatingly easy to make silly arithmetic errors. I know the process very well; but in doing ten of these I will get to the right answer on the first try on only 4 or 5 of them.

It would be good if there were a way for you and me to carry on a conversation about this problem. However, I don't know how to do that on this web site, or if it is even possible. So I will go through the details of a solution; then I hope that, if this is for an assignment to be turned in and graded, you will look at it and understand it -- instead of just turning it in and thus learning nothing from it.

Let a = amount invested in money markets

b = amount in bonds

c = amount in international stocks

d = amount in domestic stocks

Then...

(1)  [the total amount invested is $220,000] [the total amount invested is $220,000]

(2)  [the total invested in money markets and bonds is 60% of the total] [the total invested in money markets and bonds is 60% of the total]

(3)  [the amount invested in domestic stocks is 4 times the amount invested in international stocks]] [the amount invested in domestic stocks is 4 times the amount invested in international stocks]]

(4)  [the desired annual return is $8,800] [the desired annual return is $8,800]

For solving with matrices, we need to write equation (3) as  . And those decimals in equation (4) would cause a lot of difficulty; multiplying equation (4) by 200 will get rid of the decimals, giving . And those decimals in equation (4) would cause a lot of difficulty; multiplying equation (4) by 200 will get rid of the decimals, giving

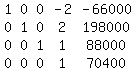

So our beginning matrix is

Our first objective is to get "1,0,0,0" in column 1. We use the 1 in position (1,1) to get 0's in the rest of column 1.

>>replace row 2 with (row 1 minus row 2)

>>replace row 4 with (row 4 minus 5 times row 1)

Our next objective is to get a 1 in position (2,2). But outside of row 1, the only non-zero number in column 2 is in row 4. So let's move row 4 up to row 2, and move rows 2 and 3 down. And while we're doing that, let's divide the new row 2 by 2 so that we have the required 1 in position (2,2).

Next use the 1 in position (2,2) to get a 0 in position (1,2), completing column 2.

>>replace row 1 with (row 1 minus row 2)

Next we want to get "0,0,1,0" in column 3. We already have the required 1 in position (3,3); use it to get 0's in the other rows of column 3.

>>replace row 1 with (row 1 plus .5 times row 3)

>>replace row 2 with (row 2 minus 1.5 times row 3)

>>replace row 4 with (row 4 minus 4 times row 3)

Next divide row 4 by -5 to get the required 1 in position (4,4).

And finally use row 4 to get 0's in the other rows of column 4.

>>replace row 1 with (row 1 plus 2 times row 4)

>>replace row 2 with (row 2 minus 2 times row 4)

>>replace row 3 with (row 3 minus row 4)

We have our answer.

She needs to invest $74,800 in money markets, $57,200 in bonds, $17,600 in international stocks, and $70,400 in domestic stocks.

|

|

|