Question 1076571: . How much do you have to deposit today so that beginning 11 years from now you can withdraw 10,000 euros a year for the next five years (periods 11 through 15) plus an additional amount of 20,000 euros in the last year (period 15)? Assume an interest rate of 6% compounded annually.

Answer by Theo(13342)   (Show Source): (Show Source):

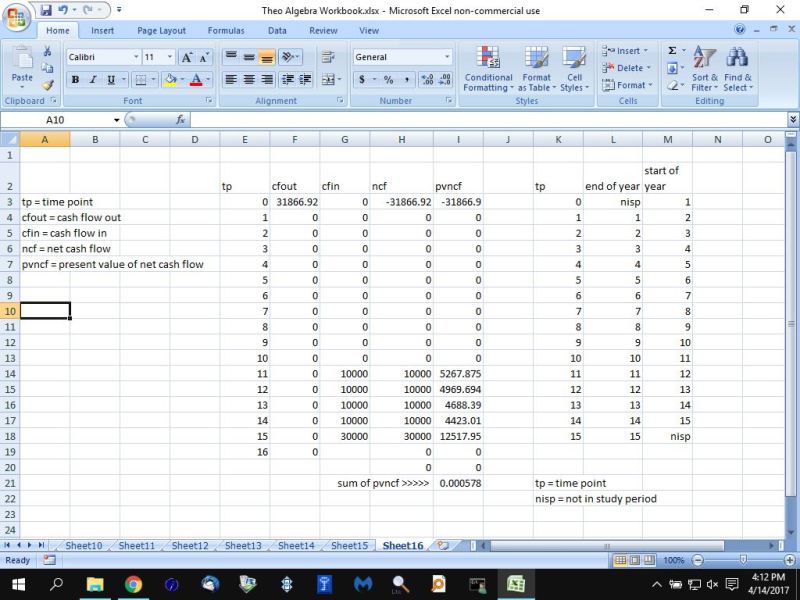

You can put this solution on YOUR website! the easiest way to solve this is find the net present value of your cash flows.

the first thing you want to do is get the present value of the cash flows coming in.

in order to do that, you need to make sure you have the time points correct.

time point 0 is the start of the first year

time point 1 is the end of the first year and the start of the second year.

you want your first payment to start at the end of the eleventh year.

that would be time point 11.

you will be taking out 10,000 in time point 11, 12, 13, 14.

you will be taking out 30,000 in time point 15.

you don't know what you will be investing in time point 0 until you get the present value of the cash flows from time point 10 to time point 15.

once you get that, you will see that the present value of those cash flows is 31, 866.92

that's how much you need to invest in time point 0 so that you can take your money out starting in time point 11.

therefore, your cash flow will be -31,866.92 in time point 0, 10,000 in time point 11, 12, 13, 14, and 30,000 in time point 15.

at the end of time point 15, you should have no money left.

that's exactly what happens as shown in the following excel printout.

you could also have used a financial calculator to get the same result.

the details cash flow and the use of the financial calculators should get you the same result or you did something wrong.

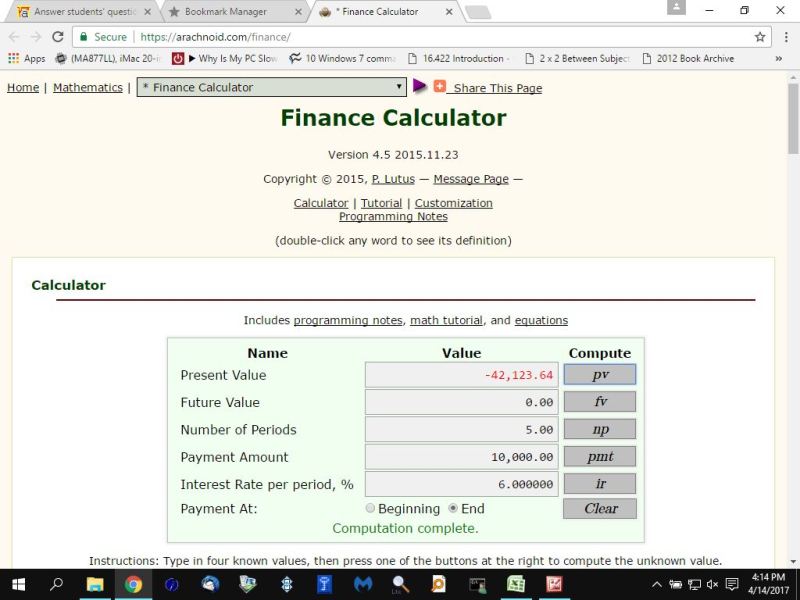

the first thing to do is to find out the present value of 10,000 at the end of each year for 5 years.

the result of that is shown below:

the present value is 42,123.64

that's what you have to invest at the start of the 11th year so you can take out 10,000 for 5 years starting at the end of the 11th year.

since that is in the start of the 11th year, that is in time point 10.

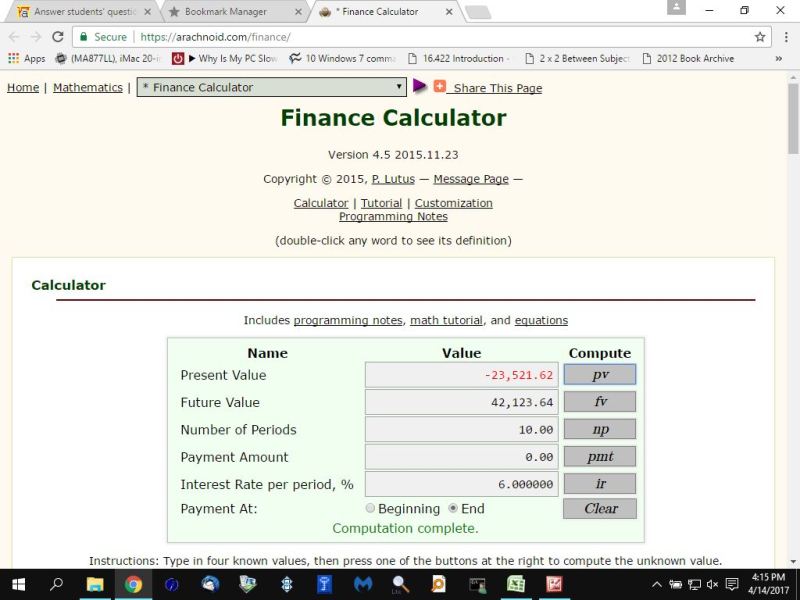

you need to get the present value of that at the start of the first year, which is time point 0.

the result of that calculation is shown below:

the present value is 23,521.62.

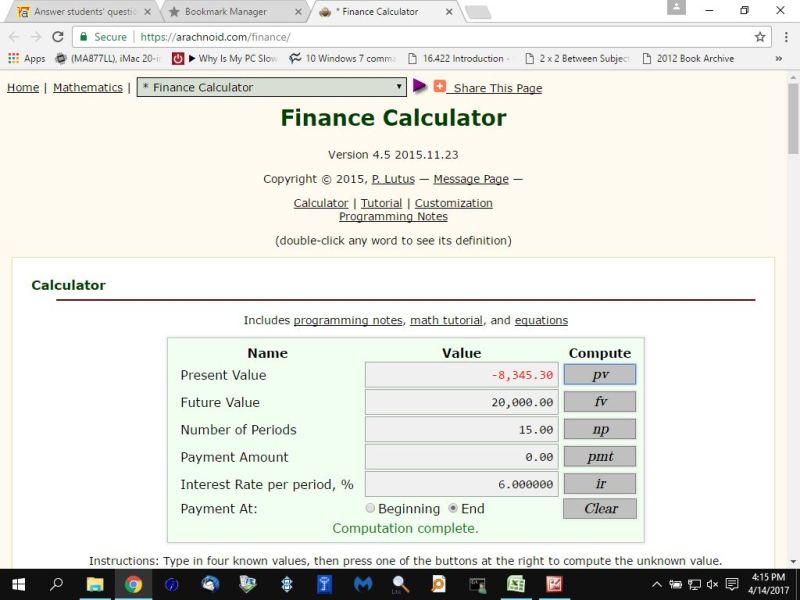

next you want to take out an additional 20,000 at the end of the 15th year.

you want to get the present value of that.

the result of that calculation is shown below:

the present value is 8,345.30.

the amount of money that you need to invest in time period 0 is 23,521.62 plus 8,345.30 for a total of 31,866.92

the detailed present value of net cash flow calculations confirms this solution is correct.

|

|

|