Question 1206598: How much must be placed each month into a retirement account earning 12%compounded month if the value of the account is to rea h $1000000 in 20 years

Answer by ikleyn(52946)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

How much must be placed at the end of each month into a retirement account earning 12%

compounded monthly, if the value of the account is to reach $1,000,000 in 20 years

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I edited your post to make it sensical.

Find and read my editing for your post (underlined).

This problem is to determine the amount of monthly payments/deposits.

Since the payments are at the end of each month, it is a classic Ordinary Annuity saving plan.

The general formula to start (which is a PREREQUISITE and which you should know from your textbook) is

FV =  ,

where FV is the future value of the account; P is the monthly payment (deposit);

r is the monthly effective percentage yield presented as a decimal;

n is the number of deposits (= the number of years multiplied by 12, in this case).

From this formula, you get for the monthly payment

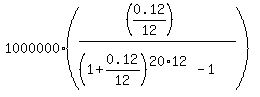

P = ,

where FV is the future value of the account; P is the monthly payment (deposit);

r is the monthly effective percentage yield presented as a decimal;

n is the number of deposits (= the number of years multiplied by 12, in this case).

From this formula, you get for the monthly payment

P =  . (1)

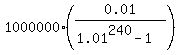

Under the given conditions, FV = $1,000,000; r = 0.12/12 = 0.01; n = 20*12 = 240.

So, according to the formula (1), you get for the monthly payment

P = . (1)

Under the given conditions, FV = $1,000,000; r = 0.12/12 = 0.01; n = 20*12 = 240.

So, according to the formula (1), you get for the monthly payment

P =  = =  = $1010.87.

Answer. The necessary monthly deposit is $1010.87. = $1010.87.

Answer. The necessary monthly deposit is $1010.87.

---------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about this subject, in clear and compact form.

When you learn from these lessons, you will be able to do similar calculations in semi-automatic mode.

|

|

|