|

Question 1205776: Can you help me with this question please?

14) Rajesh and Priya plan to retire at age 60 with a retirement income of $48,000 a year from their savings. Rather than pay themselves the whole amount at the beginning of each year, they have decided that withdrawing payments of $12,000 at the beginning of each quarter of gives them the right balance of liquidity and maximized interest earnings. They feel they can safely earn an interest rate of 5.75%, compounded quarterly, on their money and they are budgeting based on the prediction that they will live until they are 90 years old.

How much money will they have to have saved by the time they are 60 and ready to begin their retirement, in order fulfill this plan? [Blank-1]

If the same total calculated above was to be saved, but no interest earned whatsoever, how much would be available to live on each quarter? [Blank-2]

If the full 30 years are lived and quarterly budget spent, how much money in total will have been utilized in retirement? [Blank-3]

How much will have been earned in interest? [Blank-4]

Question 15)

Now that Rajesh and Priya have their saving goal calculated, and rounded up to the nearest dollar, they want to start budgeting to reach that goal. They are 40 years old currently, so they have just 20 years to save up the total nest egg retirement amount they calculated. If they assume the same interest rate, and compound frequency, but make deposits into their savings at the beginning of every month, how much would their deposit have to be each month to satisfy their retirement nest egg goal on time?

If they assume the same interest rate and compound frequency, but make deposits into their savings at the beginning of every month, how much would their deposit have to be each month to satisfy their retirement nest egg goal on time?[Blank-1]

How much interest will be earned? [Blank-2]

The answers to the questions should contain only the following characters: 0 1 2 3 4 5 6 7 8 9 .

No spaces, commas, dollar or percentage signs. These characters will cause your answer to be graded as incorrect.

Dollar amount answer should be rounded up to the whole dollar (no cents/decimals).

Interest rate answers should be rounded up, and include two decimal places

Answer by ikleyn(52915)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Can you help me with this question please?

14) Rajesh and Priya plan to retire at age 60 with a retirement income of $48,000 a year

from their savings. Rather than pay themselves the whole amount at the beginning of each year,

they have decided that withdrawing payments of $12,000 at the beginning of each quarter

of gives them the right balance of liquidity and maximized interest earnings.

They feel they can safely earn an interest rate of 5.75%, compounded quarterly,

on their money and they are budgeting based on the prediction that they will live

until they are 90 years old.

(a) How much money will they have to have saved by the time they are 60 and ready

to begin their retirement, in order fulfill this plan?

(b) If the same total calculated above was to be saved, but no interest earned whatsoever,

how much would be available to live on each quarter?

(c) If the full 30 years are lived and quarterly budget spent, how much money

in total will have been utilized in retirement?

(d) How much will have been earned in interest ?

~~~~~~~~~~~~~~~~~~~~~~

This problem is about the starting amount of a sinking fund.

The fund should provide the payments of $12,000 at the beginning of each quarter during 30 years.

The fund is compounded quarterly at the annual interest rate of 5.75%.

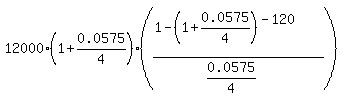

The general formula to calculate the starting amount of the account is

X =  .

In this formula, W is the regular withdrawal per quarter, W = $12000;

the factual quarterly compounding rate is r = 0.0575/4, p = 1 + r,

and the number of payment periods is n = 30 years * 4 quarters = 120. So

X = .

In this formula, W is the regular withdrawal per quarter, W = $12000;

the factual quarterly compounding rate is r = 0.0575/4, p = 1 + r,

and the number of payment periods is n = 30 years * 4 quarters = 120. So

X =  = 694044.48

dollars. It is the ANSWER to the problem's question (a).

The answer to question (b) is = 694044.48

dollars. It is the ANSWER to the problem's question (a).

The answer to question (b) is  = 5783.70 dollars.

It is the averaged available uniform withdrawal from $694044.48 at each quarter

during 30 years - if compounding does not work.

The answer to question (c) is 30*4*12000 = 1,440,000 dollars.

It is the real total amount that the family withdraws/receives from this sinking fund during 30 years.

The answer to question (d) is the difference

$1,440,000 - $694,044.48 = $745955.52.

It is the money that the sinking fund earns/accumulates in 30 years due to compounding. = 5783.70 dollars.

It is the averaged available uniform withdrawal from $694044.48 at each quarter

during 30 years - if compounding does not work.

The answer to question (c) is 30*4*12000 = 1,440,000 dollars.

It is the real total amount that the family withdraws/receives from this sinking fund during 30 years.

The answer to question (d) is the difference

$1,440,000 - $694,044.48 = $745955.52.

It is the money that the sinking fund earns/accumulates in 30 years due to compounding.

Solved.

--------------

See my lessons in this site associated with annuity saving plans and retirement plans

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Withdrawing a certain amount of money periodically from a compounded saving account (*)

- Miscellaneous problems on retirement plans

and especially lesson marked (*) in the list as the most relevant to the given problem.

/////////////////////

I do not solve the second problem here, because I do not want to turn my post into a mess.

It would be much better, if you post your second problem SEPARATELY.

By the way, it is a policy and a formal requirement of this forum

(as any other forum, where common sense dominates)

do not pack more than one problem per post.

So, I ask you NEVER pack more than one problem into each your post in the future.

Thank you.

|

|

|

| |