Question 1198671: Suppose a state lottery prize of $3 million is to be paid in 25 payments of $120,000 each at the end of each of the next 25 years. If money is worth 11%, compounded annually, what is the present value of the prize? (Round your answer to the nearest cent.)

Answer by ikleyn(52775)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Suppose a state lottery prize of $3 million is to be paid in 25 payments of $120,000 each

at the end of each of the next 25 years. If money is worth 11%, compounded annually,

what is the present value of the prize? (Round your answer to the nearest cent.)

~~~~~~~~~~~~~~~~~~~~~~

We have a sinking fund. Its initial value is unknown and we should find it - it is a present value of the fund.

We know that the initial money is deposited for 25 years at 11% annual rate,

paid out $120,000 and compounded (both) at the end of each year.

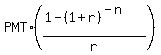

Use the formula for the present value of such sinking fund

PV =  ,

where PV is the present value, PMT is the annual payment value,

r is the annual rate, n is the number of payment/compounding (the number of years, in this problem).

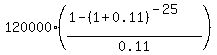

With the given data, the formula for calculations is

PV = ,

where PV is the present value, PMT is the annual payment value,

r is the annual rate, n is the number of payment/compounding (the number of years, in this problem).

With the given data, the formula for calculations is

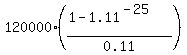

PV =  = =  = 1,010,609.36 dollars.

ANSWER. The present value of the prize is $1,010,609.36.

This amount should be deposited initially, and it will provide

no-failure payments of $120,000 at the end of each year during 25 years,

under given conditions. = 1,010,609.36 dollars.

ANSWER. The present value of the prize is $1,010,609.36.

This amount should be deposited initially, and it will provide

no-failure payments of $120,000 at the end of each year during 25 years,

under given conditions.

Solved.

|

|

|