Question 1176143: You just celebrated your child’s first birthday. You decide that you want the best future for your child and want to set up a college fund for him/her. If you can put $160 per month into an account and assume you can get an APR of 7%, how much money will you have when the child turns 18 years old?

Found 2 solutions by Boreal, ikleyn:

Answer by Boreal(15235)   (Show Source): (Show Source):

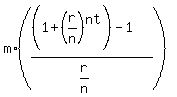

You can put this solution on YOUR website! P=m((1+(r/n)^nt )- 1)/(r/n)

P=m(1+(.07/12))^216-1)/(.07/12). Round at the end only.

=160(430.72)

=$68915.36

It is a sinking fund.

Answer by ikleyn(52788)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

To be correct, the problem MUST SAY that the account is compounded monthly.

/////////////

If the payment is made at the end of each month, then it is the standard Ordinary Annuity saving plan.

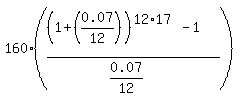

Future value FV =  In this problem, m = 160, n = 12 paying/compounding periods in an year, t = 17 years (not 18, as other tutor used in his calc.)

P =

In this problem, m = 160, n = 12 paying/compounding periods in an year, t = 17 years (not 18, as other tutor used in his calc.)

P =  = $62420.19. ANSWER = $62420.19. ANSWER

Solved.

-----------------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about this subject, in clear and compact form.

When you learn from these lessons, you will be able to do similar calculations in semi-automatic mode.

|

|

|