Question 1164634: Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

Answer by ikleyn(52878)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Determine the present value of a series of 60 monthly payments of $2,500 each

which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In this tricky problem, the monthly payments are not compounded.

Monthly payments lie in the bank and wait for the end of a quarter -

only then they are compounded, according to the problem.

So, we actually have quarterly payments of 3*2500 = 7500 dollars each, compounded quarterly.

Thus, it works as an Ordinary Annuity saving plan with quarterly payments of $7500

at the end of each quarter, compounded quarterly at the annual rate of 10%.

60 monthly payments of $2500 each mean 60/3 = 20 quarterly payments of $7500 each.

So, the future value of the account after 20 quarters will be

FV =  = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 = = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 =  .

It gives the solution

X = .

It gives the solution

X =  = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars. = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars.

Solved.

/////////////////////////////////////////////////////

On Aug. 26, 2025, I posted this problem to Google AI.

Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today.

Assume interest of 10 percent per year compounded quarterly.

The Google AI Overview solution is placed below.

The present value (PV) of the series of 60 monthly payments is approximately $127,055.64.

To calculate this, you must first convert the annual interest rate to a quarterly rate,

then find the effective monthly interest rate by converting the quarterly rate to an equivalent monthly rate.

Finally, use this effective monthly rate in the present value of annuity formula to solve for the present value.

1. Convert the Annual Rate to a Quarterly Rate

Annual Rate: 10% or 0.10

Quarters in a year: 4

Quarterly Rate (r/q): 0.10 / 4 = 0.025 or 2.5%

2. Find the Effective Monthly Interest Rate

Since payments are monthly but compounding is quarterly, we need to find the equivalent monthly interest rate.

Formula: (1 + r/q)^(1/3) - 1 = Effective Monthly Rate (i)

Calculation: (1 + 0.025)^(1/3) - 1 = 1.025^(0.3333) - 1 = 1.008264 - 1 = 0.008264 (approximately)

3. Calculate the Present Value of the Annuity

Now that we have the effective monthly interest rate, we can use the present value of an ordinary annuity formula:

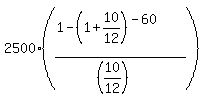

Formula: PV = PMT * [1 - (1 + i)^(-n)] / i

PMT (Payment): $2,500

i (Effective Monthly Rate): 0.008264

n (Number of Payments): 60

Calculation:

PV = $2,500 * [1 - (1 + 0.008264)^(-60)] / 0.008264

PV = $2,500 * [1 - (1.008264)^(-60)] / 0.008264

PV = $2,500 * [1 - 0.61158] / 0.008264

PV = $2,500 * 0.38842 / 0.008264

PV = $2,500 * 47.00778

PV = $127,055.64

/////////////////////////////////////////

My (@ikleyn) comments.

The solution above, produced by this AI, is INCORRECT.

It is CONCEPTUALLY incorrect and TECHNICALLY incorrect in both aspects: conceptual and technical.

It is conceptually incorrect, since it introduces monthly compounding and operates with them.

But, according to the problem's description, the bank does not make monthly compounding.

It makes the quarterly compounding, ONLY.

They say that they select the monthly effective interest rate to make

monthly compounding equivalent to quarterly compounding.

But this equivalence works ONLY if there are no monthly deposits.

It they are and participate in compounding, then the two models

(one with monthly compounding and another with quarterly compounding) are NOT equivalent.

So, when the solution assumes monthly compounding of monthly deposits, it (the solution)

goes against the way, described in the problem, on how the bank treats this account.

Technically, the computations of PV are incorrect.

The correct calculation is THIS

PV =  = 117,663.42 dollars (without making any intermediate rounding till the end). = 117,663.42 dollars (without making any intermediate rounding till the end).

Compare it with the number of 127,055.64 dollars in the solution by the AI.

The difference is HUGE - - - not acceptable for finance predictions.

But even $117,663.42 is not a correct answer, since it is obtained via wrong conceptual assumption.

The correct solution/answer, adequate to the given problem, is what is given in my solution/post above.

|

|

|