.

I will assume that the person deposits a regular amount at the end of every quarter during 25 years

and then withdraws $32000 at the beginning of each of the next 10 years, making the account empty after 10 withdrawals.

Different schemes are possible, and each such a scheme requires a separate consideration - but what I propose

is natural and reasonable, making the problem correctly and precisely formulated.

Solution

I will solve this problem in two steps.

Step 1.

First, I will determine how much money X should be accumulated on the account during 25 years,

in order for to have enough to withdraw $32000 at the beginning of each of the next 10 years.

By withdrawing $32000 at the beginning of each year, the account (the remaining money) still earns 8% per annum compounded quarterly.

It means that effective annual rate for this account is  = 1.082432 compounded annually.

So, when you withdraw money during 10 years from your account, it still earns with effective rate of 1.082432 per year compounded annually.

Thus, it works as if it would be compounded annually at the rate of 8.2432%.

Such scheme withdrawing money was considered at the lesson

Withdrawing a certain amount of money periodically from a compounded saving account

in this site.

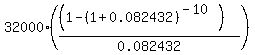

The formula for the account value before it starts discharging is

M =

= 1.082432 compounded annually.

So, when you withdraw money during 10 years from your account, it still earns with effective rate of 1.082432 per year compounded annually.

Thus, it works as if it would be compounded annually at the rate of 8.2432%.

Such scheme withdrawing money was considered at the lesson

Withdrawing a certain amount of money periodically from a compounded saving account

in this site.

The formula for the account value before it starts discharging is

M =  , (1)

which gives us the value at the account of

M = 212387 dollars.

, (1)

which gives us the value at the account of

M = 212387 dollars.

Step 2.

Now I am in position to determine how much the person should deposit each quarter during 25 years

to accumulate 212387 dollars in his account. The number of quarter periods is 25*4 = 100.

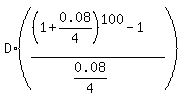

Now we have a standard Annuity saving plan, and the formula is

212387 =  , (2)

where D is the quarterly deposit amount.

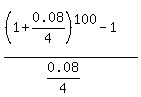

The multiplier

, (2)

where D is the quarterly deposit amount.

The multiplier  is equal 312.2323 ,

which implies from equation (2) that D =

is equal 312.2323 ,

which implies from equation (2) that D =  = 680.22.

It is your answer: During 25 years the person should deposit $680.22 at the end of each quarter to his account,

in order to withdraw $32000 at the beginning of each year during 10 years at given conditions.

= 680.22.

It is your answer: During 25 years the person should deposit $680.22 at the end of each quarter to his account,

in order to withdraw $32000 at the beginning of each year during 10 years at given conditions.

------------------

In this site, there is a group of lessons associated with annuity saving plans and retirement plans. They are

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Withdrawing a certain amount of money periodically from a compounded saving account

- Miscellaneous problems on retirement plans

From these lessons, you can learn the subject and can see many similar solved problems.