Question 1113633: Best Motors has hired Robert Trent as its new president. Terms included the company’s agreeing to pay retirement benefits of $17,900 at the end of each semiannual period for 12 years. This will begin in 4,015 days. If the money can be invested at 8% compounded semiannually, what must the company deposit today to fulfill its obligation to Robert?

Found 3 solutions by solver91311, ikleyn, MathTherapy:

Answer by solver91311(24713)   (Show Source): (Show Source):

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

I will interpret the condition in this way:

1) We have first the period of  = 11 years, when the initial deposit of X dollars grows at 8% compounded semiannually.

2) Then the second period starts, when the company withdraw $17900 semiannually for 12 years to fulfill its obligation to Robert.

During this period of 12 years the rest of the account is still compounded at 8% semiannually,

and at the end of the 12 years period the amount vanishes. = 11 years, when the initial deposit of X dollars grows at 8% compounded semiannually.

2) Then the second period starts, when the company withdraw $17900 semiannually for 12 years to fulfill its obligation to Robert.

During this period of 12 years the rest of the account is still compounded at 8% semiannually,

and at the end of the 12 years period the amount vanishes.

The condition does not formulate all these details, so, from one side, it is my own interpretation / (fantasy).

From the other side, only this interpretation makes the problem really interesting, and it is major reason, why I start to work on it.

Solution

1. After 11 years, the initial deposit of X dollars becomes

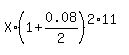

P =  = =  .

2. Then the following next 12 years period we have the ordinary annuity plane with the NEGATIVE semiannual deposit (= withdraw) of $17900.

So, the usual ORDINARY ANNUITY PLAN formula works with the negative deposit of 17900 dollars:

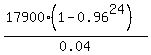

P = .

2. Then the following next 12 years period we have the ordinary annuity plane with the NEGATIVE semiannual deposit (= withdraw) of $17900.

So, the usual ORDINARY ANNUITY PLAN formula works with the negative deposit of 17900 dollars:

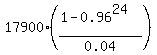

P =  = =  .

So your equation to find X is THIS: .

So your equation to find X is THIS:

= =  .

x*2.369919 = 279502.6 =====> X = .

x*2.369919 = 279502.6 =====> X =  = 117937.60.

Answer. Under the given condition and interpretation the initial deposit the company must make TODAY is 117937.60 dollars. = 117937.60.

Answer. Under the given condition and interpretation the initial deposit the company must make TODAY is 117937.60 dollars.

Solved.

----------------

See the lesson

- Ordinary Annuity saving plans and geometric progressions

in this site.

================

I absolutely agree with John in that you do not need copy your post many times - it only annoys/irritates the tutors and works against your best interests.

Answer by MathTherapy(10552)   (Show Source): (Show Source):

You can put this solution on YOUR website! Best Motors has hired Robert Trent as its new president. Terms included the company’s agreeing to pay retirement benefits of $17,900 at the end of each semiannual period for 12 years. This will begin in 4,015 days. If the money can be invested at 8% compounded semiannually, what must the company deposit today to fulfill its obligation to Robert?

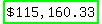

If the interest rate of 8% were to remain the same, amount needed to pay out $17,900 every 6 months for 12 years, or for 24 periods, would be: $272,920.64.

This is your FUTURE VALUE, or the amount needed in 4,065 days, or in

The PRESENT VALUE, based on a FUTURE VALUE of $272,920.64, an interest rate of 8%, semi-annual compounding periods, and time of 11 years ( ) = ) =  . .

This is the required deposit, TODAY!!

|

|

|