Question 1065816: 1.Betty, who has just started her first full-time salary job is determined to have $1 million in her account by the time she retires. She is now 25 and hopes to retire at 65 years of age. Her investments have been earning 5% annual return, which could appropriately be calculated as compounded monthly, and she thinks it’s realistic that can be maintained. How much would Betty have to put aside each month, in order to reach her goal?

2.Aya and Harumi would like to buy a house and their dream house costs $500,000. They have $50,000 saved up for a down payment but would still need to take out a mortgage loan for the remaining $450,000 and they’re not sure whether they could afford the monthly payments. The bank has offered them an interest rate of 3.5%, compounded monthly. How much would they have to be able to afford to pay each month in order to pay off her mortgage in 30 years?

Found 2 solutions by addingup, MathTherapy:

Answer by addingup(3677)   (Show Source): (Show Source):

You can put this solution on YOUR website! 40 years

1,000,000

5% annual return compounded monthly

-------------------------

1,000,000((0.05/12)/(((1+(0.05/12))^(12*40)-1)

1,000,000(0.00417/((1.0042^480)-1)

1,000,000(0.00417/(7.477-1)) = 643.817

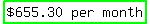

She has to save 643.82 per month.

---------------------------------------------

John

Answer by MathTherapy(10552)   (Show Source): (Show Source):

You can put this solution on YOUR website!

1.Betty, who has just started her first full-time salary job is determined to have $1 million in her account by the time she retires. She is now 25 and hopes to retire at 65 years of age. Her investments have been earning 5% annual return, which could appropriately be calculated as compounded monthly, and she thinks it’s realistic that can be maintained. How much would Betty have to put aside each month, in order to reach her goal?

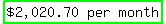

2.Aya and Harumi would like to buy a house and their dream house costs $500,000. They have $50,000 saved up for a down payment but would still need to take out a mortgage loan for the remaining $450,000 and they’re not sure whether they could afford the monthly payments. The bank has offered them an interest rate of 3.5%, compounded monthly. How much would they have to be able to afford to pay each month in order to pay off her mortgage in 30 years?

1.

2.

|

|

|