Question 1146477: Jenny puts aside $20 at the end of each month for 3 years. How much will she have then of the investment earns 8.2% p.a., paid monthly?

Found 3 solutions by Theo, mananth, ikleyn:

Answer by Theo(13342)   (Show Source): (Show Source):

You can put this solution on YOUR website! the investment is 20 dollars at the end of each month for 3 years = 3 * 12 = 36 months.

the interest rate if 8.2% per month compounded monthly = 8.2% / 12 = .6833333333...% per month.

it's a never ending decimal, but carrying out the 3's for 8 positions is usually sufficient.

using the online calculator at https://arachnoid.com/finance/, i get a future value of $813.16 after i click on FV.

my inputs and outputs are shown below, using this online calculator.

Answer by mananth(16949)   (Show Source): (Show Source):

Answer by ikleyn(53618)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Jenny puts aside $20 at the end of each month for 3 years. How much will she have then of the investment earns

8.2% p.a., paid monthly?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This my post is written in opposite to the solution by @mananth in his post.

This Finance problem assumes a precise solution, correct to a single cent.

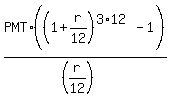

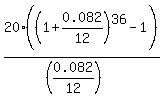

Use a standard formula for a Future value of an ordinary annuity

FV =  = =  = 813.16 dollars. ANSWER = 813.16 dollars. ANSWER

Solved. In opposite to the answer in the post by @mananth, my answer is precise to one single cent.

To get a precise solution, use MS Excel spreadsheets or Google spreadsheet.

Write the formula in any text editor with the numbers and then copy-paste it into a spreadsheet cell " as is ".

You will get a precise answer with the precision, which is usually enough for

normal/regular financial calculations, without intermediate rounding.

Another, alternative way, is to use specialized financial online calculators.

Many of them, often free of charge and many-times repeatedly tested, can be found in the Internet

using appropriate key words for search, for example "online calculator future value of an annuity".

Below are the links to some popular web-sites with reliable online calculators

https://www.calculatorsoup.com/calculators/financial/future-value-annuity-calculator.php

https://www.calculator.net/annuity-calculator.html

https://www.omnicalculator.com/finance/annuity-future-value

In this concrete calculations, I used MS Excel in my computer.

Happy calculations with reliable tools !

|

|

|