Question 1185416: You just sold a house for $200,000. You can invest the money at 5%/a compounded semiannually. How much could you withdraw every 6 months, starting in 6 months, for the next 20 years?

Answer by ikleyn(52878)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

You just sold a house for $200,000. You can invest the money at 5%/a compounded semiannually.

How much could you withdraw every 6 months, starting in 6 months, for the next 20 years?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This problem is about a sinking fund.

The starting amount is A = $200,000.

The fund is compounded semi-annually at the annual compounding rate r = 5%.

You want to withdraw a regular amount at the end of each 6 months period during next 20 years.

They want you determine the value of this regular withdraw amount W.

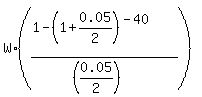

Use the formula for a sinking fund

A =  , (1)

where A is the starting amount, W is the regular withdraw amount semi-annually,

r is the annual compounding rate, m is the number of withdrawals per year (m= 2 in this problem),

n is the total number of withdrawals/compounding (twice the number of years, in this problem), , (1)

where A is the starting amount, W is the regular withdraw amount semi-annually,

r is the annual compounding rate, m is the number of withdrawals per year (m= 2 in this problem),

n is the total number of withdrawals/compounding (twice the number of years, in this problem),

is the effective rate of compounding per the 6 months period.

With the given data, formula (1) takes the form

200000 = is the effective rate of compounding per the 6 months period.

With the given data, formula (1) takes the form

200000 =  = =  = W*25.102775 dollars.

From this equation, we find the semiannual withdraw value

W = = W*25.102775 dollars.

From this equation, we find the semiannual withdraw value

W =  = 7967.25 dollars.

ANSWER. The semi-annual withdrawal value is $7967.25. = 7967.25 dollars.

ANSWER. The semi-annual withdrawal value is $7967.25.

Solved.

|

|

|