Question 1165581: How long must a temporary warehouse last to be desirable investment if it costs $ 16,000 to build, has annual maintenance and

operating cost of $ 360, provides storage space-value at $ 3,600 per year and if the company MARR is 10%? Hint: Treat MARR

as interest rate, i.

a. 8 years b. 9 years c.7 years d. 6 years

Answer by ikleyn(52932)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

How long must a temporary warehouse last to be desirable investment if it costs $ 16,000 to build,

has annual maintenance and operating cost of $ 360, provides storage space-value at $ 3,600 per year

and if the company MARR is 10%?

Hint: Treat MARR as interest rate, i.

a. 8 years b. 9 years c.7 years d. 6 years

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

First, the definition of the MARR conception from Google AI:

In finance, MARR stands for Minimum Acceptable Rate of Return, also known as the hurdle rate

or minimum attractive rate of return. It is the minimal profit that an investor or company

is willing to accept from an investment or project, considering the project's risk and

the opportunity cost of other available investments.

A project must exceed its MARR to be considered financially viable and worthwhile for investment.

Now we can re-phrase the problem in more accessible Math terms, that are understandable

not only to specialists in Finance, but also to a wider audience of regular students.

A company "Warehouse, Inc" is going to loan $16,000 to construct a warehouse.

The warehouse will provide the storage space-value at $ 3,600 per year. It will have the annual

maintenance and operating cost of $360 per year. The loan interest is 10% compounded yearly.

How long the warehouse must function to recoup the cost of the loan and other relevant costs?

Solution

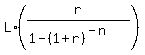

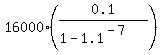

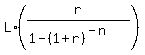

Let PMT be the annual payment for the loan (which is some constant value over the years).

Then the inequality for the project to be profitable is

PMT + 360 <= 3600, (1)

which implies

PMT <= 3600 - 360 = 3240. (2)

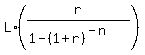

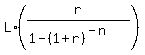

Now, let's calculate PMT for 6, 7, 8 and 9 years with the interest rate r = 10% = 0.1.

Use the standard formula

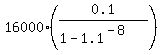

for n = 6 years PMT =  = =  = 3673.72;

for n = 7 years PMT = = 3673.72;

for n = 7 years PMT =  = =  = 3286.49;

for n = 8 years PMT = = 3286.49;

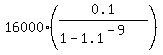

for n = 8 years PMT =  = =  = 2999.10;

for n = 9 years PMT = = 2999.10;

for n = 9 years PMT =  = =  = 2778.25.

Comparing these numbers with 3240 in the right side of (2), you see that to be profitable,

the warehouse should function at least 8 years. <<<---=== ANSWER = 2778.25.

Comparing these numbers with 3240 in the right side of (2), you see that to be profitable,

the warehouse should function at least 8 years. <<<---=== ANSWER

Solved.

|

|

|