Question 1137944: You want to be able to withdraw $20,000 from your account each year for 20 years after you retire.

You expect to retire in 15 years.

If your account earns 8% interest, how much will you need to deposit each year until retirement to achieve your retirement goals?

Found 2 solutions by ikleyn, MathTherapy:

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Let me re-formulate the problem to make it precisely correct.

You want to be able to withdraw $20,000 from your account at the beginning of each year for 20 years after you retire.

You expect to retire in 15 years.

If your account earns 8% interest compounded annually, how much will you need to deposit each year until retirement

to achieve your retirement goals?

My insertions are underlined in the text.

I will solve this re-formulated problem in two steps.

Step 1.

First, I will determine how much money X should be accumulated on the account during 15 years to the time of retiring,

in order for to have enough to withdraw $20000 at the beginning of each year for 20 years.

By withdrawing $20000 each year, my compound account (the remaining money) still earns 8% per annum, so everything works as it was

considered/described at the lesson Withdrawing a certain amount of money periodically from a compounded saving account in this site.

Thus the formula for the account value before it starts recharging is

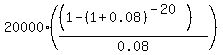

M =  , (1)

which gives us the value at the account of

M = 196362.95 dollars. , (1)

which gives us the value at the account of

M = 196362.95 dollars.

Step 2.

Now I am in position to determine how much I should deposit at the end of each year during 15 years to the starting moment of the retiring

to accumulate 196362.95 dollars in my account.

It is the standard Annuity saving plan, and the formula is

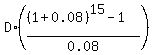

196362.95 =  , (2)

where D is the annual deposit amount.

The multiplier , (2)

where D is the annual deposit amount.

The multiplier  = 27.15211,

which implies from equation (2) that D = = 27.15211,

which implies from equation (2) that D =  = 7231.96.

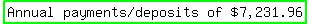

It is your answer: During 15 years, you should deposit $7231.96 at the end of each year to your account,

in order to have the income of $20000 annually from yours account for 20 years. = 7231.96.

It is your answer: During 15 years, you should deposit $7231.96 at the end of each year to your account,

in order to have the income of $20000 annually from yours account for 20 years.

--------------

My lessons in this site associated with annuity saving plans and retirement plans are

- Geometric progressions

- The proofs of the formulas for geometric progressions

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Withdrawing a certain amount of money periodically from a compounded saving account

- Miscellaneous problems on retirement plans

Also, you have this free of charge online textbook in ALGEBRA-II in this site

- ALGEBRA-II - YOUR ONLINE TEXTBOOK.

The referred lessons are the part of this online textbook under the topic "Geometric progressions".

Save the link to this textbook together with its description

Free of charge online textbook in ALGEBRA-II

https://www.algebra.com/algebra/homework/complex/ALGEBRA-II-YOUR-ONLINE-TEXTBOOK.lesson

into your archive and use when it is needed.

/\/\/\/\/\/\/\/\/

Tutor @MathTherapy absolutely correctly noticed the typo in my formula, which led me to incorrect answer in my previous version.

I just corrected and re-calculated it, getting the same answer as @MathTherapy.

Now you have the corrected version here.

Dear tutor @MathTherapy, thanks for your notice !

Answer by MathTherapy(10552)   (Show Source): (Show Source):

You can put this solution on YOUR website! You want to be able to withdraw $20,000 from your account each year for 20 years after you retire.

You expect to retire in 15 years.

If your account earns 8% interest, how much will you need to deposit each year until retirement to achieve your retirement goals?

It is TRUE that $196,362.95 is needed at the beginning of retirement in order to withdraw $20,000 annually for 20 years.

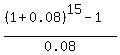

However, to calculate a FV of $196,362.95, the following PMT (payment) formula should be used:  OR OR

where:

= Payment made at the END of each time period = Payment made at the END of each time period

= Future/Accumulated Value of an Ordinary Annuity (196,362.95, in this case) = Future/Accumulated Value of an Ordinary Annuity (196,362.95, in this case)

= Annual Interest rate (8%, or .08, in this case) = Annual Interest rate (8%, or .08, in this case)

= Number of ANNUAL compounding periods (annually, or 1, in this case) = Number of ANNUAL compounding periods (annually, or 1, in this case)

= Time, in years (15, in this case) = Time, in years (15, in this case)

Substitute all variables into the above formula and you get:

You're very welcome, @IKLEYN....My pleasure.

|

|

|