Question 1137034: At age 25, to save for retirement, you decide to deposit $75.00 into an IRA at the end of each month, at an interest rate of 6.5% PER YEAR COMPOUNDED DAILY. How much will you have from the IRA when you retire at age 65?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

It works very similar to Ordinary Annuity saving plan.

But since the deposit periods and compounding periods are different, it requires some modifications.

I will explain which modifications are needed.

In my solution, I will assume that each month is 30 days (so one/each year is 360 days).

You deposit P = 75 dollars at the end of each month. This amount of 75 dollars is compounded daily next month

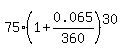

according to the formula

F =  and becomes

F = 75.40732 dollars.

I could round it to cents, but do not want to do it now.

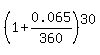

Also, the monthly growing factor is

G =

and becomes

F = 75.40732 dollars.

I could round it to cents, but do not want to do it now.

Also, the monthly growing factor is

G =  = 1.005431.

and it shows that the standard "r" of the Ordinary Annuity saving plan is r= 0.005431, considered for monthly compounding.

So, the process works in a way as if you deposit not $75.00, but 75.40732 dollars at the end of each month,

and if the account is compounded NOT DAILY, but MONTHLY with the monthly value of r equal to 0.005431.

After making this notice, you just apply the standard formula for the Ordinary Annuity saving plan, assuming

monthly payment is 75.40732 dollars deposited at the end of each month;

compounding period is ONE MONTH; and

the number of compounding periods is 12*40.

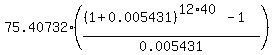

So, apply now the standard Ordinary Annuity saving plan formula

Future value = = 1.005431.

and it shows that the standard "r" of the Ordinary Annuity saving plan is r= 0.005431, considered for monthly compounding.

So, the process works in a way as if you deposit not $75.00, but 75.40732 dollars at the end of each month,

and if the account is compounded NOT DAILY, but MONTHLY with the monthly value of r equal to 0.005431.

After making this notice, you just apply the standard formula for the Ordinary Annuity saving plan, assuming

monthly payment is 75.40732 dollars deposited at the end of each month;

compounding period is ONE MONTH; and

the number of compounding periods is 12*40.

So, apply now the standard Ordinary Annuity saving plan formula

Future value =  = =  = 173,021.73 dollars. ANSWER = 173,021.73 dollars. ANSWER

----------------

On Ordinary Annuity saving plans, see the lessons

- Ordinary Annuity saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

in this site.

The lessons contain EVERYTHING you need to know about the classic Ordinary Annuity saving plan, in clear and compact form.

|

|

|