|

Question 1205569: You can purchase an investment that pays $75,000 at the beginning of each year for twenty years. Similar investments earn an 8% interest rate. How much will the payments be worth to you at the end of fifteen years?

Answer by ikleyn(52814)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

You can purchase an investment that pays $75,000 at the beginning of each year for twenty years.

Similar investments earn an 8% interest rate. How much will the payments be worth to you

at the end of fifteen years?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Similar account at the end of fifteen years is able to provide payments of $75,000

at the beginning of each year for 5 (five) years.

So, the question is: find the amount, which, when invested at 8% annual interest rate,

will provide payment (withdrawing) $75,000 at the beginning of each year for five years.

+----------------------------------------------+

| It is a standard question/problem about |

| a starting amount of a sinking fund. |

+----------------------------------------------+

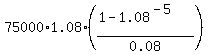

The general formula to calculate the starting amount at the account is

X =  .

In this formula, W is the regular annual withdrawal, W = $75000; the factual annual compounding rate

is r = 0.08, p = 1 + 0.08 = 1.08, and the number of payment periods is n = 5 years. So

X = .

In this formula, W is the regular annual withdrawal, W = $75000; the factual annual compounding rate

is r = 0.08, p = 1 + 0.08 = 1.08, and the number of payment periods is n = 5 years. So

X =  = 323409.52 dollars.

It is the ANSWER to the problem's question. = 323409.52 dollars.

It is the ANSWER to the problem's question.

Solved.

--------------

See my lessons in this site associated with annuity saving plans and retirement plans

- Ordinary Annuity saving plans and geometric progressions

- Annuity Due saving plans and geometric progressions

- Solved problems on Ordinary Annuity saving plans

- Withdrawing a certain amount of money periodically from a compounded saving account (*)

- Miscellaneous problems on retirement plans

and especially lesson marked (*) in the list as the most relevant to the given problem.

|

|

|

| |