Tutors Answer Your Questions about Money Word Problems (FREE)

Question 1206600: Suppose you can afford to pay at most $2650 per month for a mortgage payment. If the maximum amortization period you can get is 20 years, and you must pay 6% interest per year compounded annually, what is the most expensive house you can buy? How much interest will you have paid to the lender at the end of the loan?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Suppose you can afford to pay at most $2650 per month for a mortgage payment. If the maximum amortization period

you can get is 20 years, and you must pay 6% interest per year compounded annually, what is the most expensive

house you can buy? How much interest will you have paid to the lender at the end of the loan?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This problem is tricky, since the payments are monthly, while compounding are annually.

So, the payments are desynchronized with compounding.

It means that monthly payments lie in the bank with no move and wait for the end of a year -

only then they are compounded, according to the problem.

Classic formulas for loan/mortgage are applicable for synchronized payments/compounding.

But we can modify the situation EQUIVALENTLY to get payments/compounding synchronized.

Indeed, we actually have annual payments of 12*2650 = 31800 dollars each, compounded annually.

Thus, it works as a classic loan for 20 years with annual payments of $31800

at the end of each year, compounded annually at the annual rate of 6%.

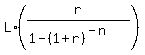

Now apply a standard loan formula

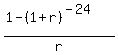

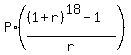

PMT =  where PMT is the annual payment ($31800); L is the loaned amount; r = 0.06 is the percentage rate

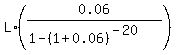

of rounding and n = 20 years. Then the formula becomes

31800 =

where PMT is the annual payment ($31800); L is the loaned amount; r = 0.06 is the percentage rate

of rounding and n = 20 years. Then the formula becomes

31800 =  .

From it, we get

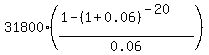

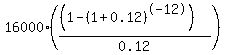

L = .

From it, we get

L =  = 364743.50.

It means that the most expensive house you can buy under given conditions is for $364,743.50. <<<---=== ANSWER

You will pay for the loan 20*12*2650 = 636000 dollars.

It means that interest you have paid to the lender for the loan is

636,000 - 364,743.50 = 271256.50 dollars. <<<---=== ANSWER = 364743.50.

It means that the most expensive house you can buy under given conditions is for $364,743.50. <<<---=== ANSWER

You will pay for the loan 20*12*2650 = 636000 dollars.

It means that interest you have paid to the lender for the loan is

636,000 - 364,743.50 = 271256.50 dollars. <<<---=== ANSWER

At this point, the problem is solved completely.

//////////////////////////////////////////

The solution in the post by @Theo is inadequate to the problem.

It is because Theo introduces, considers and treats monthly compounding; but the bank does not perform

monthly compounding. According to the problem, the bank makes annual compounding, ONLY.

Theo introduces equivalent monthly rate; but it works as an equivalent scheme only under condition

when there are no intermediate compounding inside a year. When there are intermediate monthly compounding,

it immediately destroys equivalency.

Had the problem admit monthly compounding, the solution by @Theo would be correct.

But under the conditions, described in the post, @Theo' solution is inadequate.

It is why I called this problem "tricky".

It has a hidden underwater stone as a trap, and, therefore, should be treated carefully.

Question 1207430: A property worth $35 OOO is purchased for 10% down and semi-annual payments of $2100 for 12 years. What is the nominal annual rate of interest if interest is compounded quarterly?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

A property worth $35,000 is purchased for 10% down and semi-annual payments of $2100 for 12 years.

What is the nominal annual rate of interest if interest is compounded quarterly?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The solution by tutor @Theo has an error (or a typo).

His answer 8.035524952% is incorrect.

I came to bring a correct solution, right numbers and proper answer.

Down payment is 10% of $35,000, i.e. 0.1*35000 = 3500 dollars.

Hence, the loan is the rest amount of $35,000 - $3,500 = $31,500.

+------------------------------------------------------------+

| Notice that, as it is given in the problem, semi-annual |

| payments are desynchronized with quarterly compounding. |

+------------------------------------------------------------+

Nevertheless, we can synchronize payments and compounding by considering an EQUIVALENT scheme

with semi-annual compounding with the effective growth coefficient 'r' semi-annually.

This coefficient 'r' is not known now, and we should find it from the problem.

We then have a loan of $31,500 with semi-annual payments of $2100 and semi-annual compounding

with the effective semi-annual rate of r.

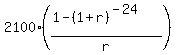

Write the standard loan equation for such a loan

= =

= =  15 =

15 =  Solve this equation numerically to find 'r'.

I used online calculator https://www.wolframalpha.com/calculators/equation-solver-calculator/

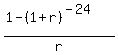

It found the approximate real solution r = 0.0416015.

Thus, in the equivalent scheme, the semi-annual effective rate is 0.0416015.

// Notice that till point my solution coincides with that by @Theo.

Hence, the effective semi-annual growth factor is 1+r = 1.0416015.

It implies that in the basic scheme, the effective quarterly growth factor is the square root of that

Solve this equation numerically to find 'r'.

I used online calculator https://www.wolframalpha.com/calculators/equation-solver-calculator/

It found the approximate real solution r = 0.0416015.

Thus, in the equivalent scheme, the semi-annual effective rate is 0.0416015.

// Notice that till point my solution coincides with that by @Theo.

Hence, the effective semi-annual growth factor is 1+r = 1.0416015.

It implies that in the basic scheme, the effective quarterly growth factor is the square root of that

= 1.020589.

Hence, the effective quarterly rate is 0.020589.

Then the annual effective rate is four times this, or 4*0.020589 = 0.082388.

Thus the nominal annual compounding interest is 8.2388%. <<<---=== ANSWER = 1.020589.

Hence, the effective quarterly rate is 0.020589.

Then the annual effective rate is four times this, or 4*0.020589 = 0.082388.

Thus the nominal annual compounding interest is 8.2388%. <<<---=== ANSWER

Solved.

Question 1207426: What payment made at the end of each year for 18 years will amount to $16,000 at 4.2% compounded monthly?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

What payment made at the end of each year for 18 years will amount to $16,000 at 4.2% compounded monthly?

~~~~~~~~~~~~~~~~~~~~

In his post, tutor @Theo solved this problem using a calculator,

and described a methodology solving this problem using calculator.

It is good, but since this website is intended to teach mathematical methods,

I present here mathematical solution with all detailed explanations.

As it is given in the post, this annuity is not standard: the payments are made at the end of each year,

while compounding is made at the end of each month.

Analytic formulas exist only for coinciding schedules of payments and compounding.

But we can use an equivalent standard synchronized scheme, considering payments at the end of each year

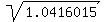

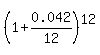

and compounding at the end of each year with the  annual multiplicative growth rate

1+r = annual multiplicative growth rate

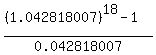

1+r =  = 1.042818007. (1)

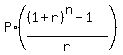

Now we can use a standard formula for such ordinary annuity

FV = = 1.042818007. (1)

Now we can use a standard formula for such ordinary annuity

FV =  . (2)

In this formula, FV is the future value in 18 years; P is the annual payment, the unknown value

which we should find.

We calculate the factor in the formula (2) separately . (2)

In this formula, FV is the future value in 18 years; P is the annual payment, the unknown value

which we should find.

We calculate the factor in the formula (2) separately

= =  = 26.31908947.

Then from formula (2) we find

P = = 26.31908947.

Then from formula (2) we find

P =  = =  = 607.93 dollars.

Thus we found out the annual payment value. It is $607.93. ANSWER = 607.93 dollars.

Thus we found out the annual payment value. It is $607.93. ANSWER

Solved.

----------------------------------

My result is precisely consisted with the answer by @Theo.

Now you can solve similar problems mathematically and check them using calculator.

It is a good and reliable strategy.

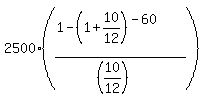

Question 1164634: Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Determine the present value of a series of 60 monthly payments of $2,500 each

which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In this tricky problem, the monthly payments are not compounded.

Monthly payments lie in the bank and wait for the end of a quarter -

only then they are compounded, according to the problem.

So, we actually have quarterly payments of 3*2500 = 7500 dollars each, compounded quarterly.

Thus, it works as an Ordinary Annuity saving plan with quarterly payments of $7500

at the end of each quarter, compounded quarterly at the annual rate of 10%.

60 monthly payments of $2500 each mean 60/3 = 20 quarterly payments of $7500 each.

So, the future value of the account after 20 quarters will be

FV =  = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 = = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 =  .

It gives the solution

X = .

It gives the solution

X =  = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars. = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars.

Solved.

/////////////////////////////////////////////////////

On Aug. 26, 2025, I posted this problem to Google AI.

Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today.

Assume interest of 10 percent per year compounded quarterly.

The Google AI Overview solution is placed below.

The present value (PV) of the series of 60 monthly payments is approximately $127,055.64.

To calculate this, you must first convert the annual interest rate to a quarterly rate,

then find the effective monthly interest rate by converting the quarterly rate to an equivalent monthly rate.

Finally, use this effective monthly rate in the present value of annuity formula to solve for the present value.

1. Convert the Annual Rate to a Quarterly Rate

Annual Rate: 10% or 0.10

Quarters in a year: 4

Quarterly Rate (r/q): 0.10 / 4 = 0.025 or 2.5%

2. Find the Effective Monthly Interest Rate

Since payments are monthly but compounding is quarterly, we need to find the equivalent monthly interest rate.

Formula: (1 + r/q)^(1/3) - 1 = Effective Monthly Rate (i)

Calculation: (1 + 0.025)^(1/3) - 1 = 1.025^(0.3333) - 1 = 1.008264 - 1 = 0.008264 (approximately)

3. Calculate the Present Value of the Annuity

Now that we have the effective monthly interest rate, we can use the present value of an ordinary annuity formula:

Formula: PV = PMT * [1 - (1 + i)^(-n)] / i

PMT (Payment): $2,500

i (Effective Monthly Rate): 0.008264

n (Number of Payments): 60

Calculation:

PV = $2,500 * [1 - (1 + 0.008264)^(-60)] / 0.008264

PV = $2,500 * [1 - (1.008264)^(-60)] / 0.008264

PV = $2,500 * [1 - 0.61158] / 0.008264

PV = $2,500 * 0.38842 / 0.008264

PV = $2,500 * 47.00778

PV = $127,055.64

/////////////////////////////////////////

My (@ikleyn) comments.

The solution above, produced by this AI, is INCORRECT.

It is CONCEPTUALLY incorrect and TECHNICALLY incorrect in both aspects: conceptual and technical.

It is conceptually incorrect, since it introduces monthly compounding and operates with them.

But, according to the problem's description, the bank does not make monthly compounding.

It makes the quarterly compounding, ONLY.

They say that they select the monthly effective interest rate to make

monthly compounding equivalent to quarterly compounding.

But this equivalence works ONLY if there are no monthly deposits.

It they are and participate in compounding, then the two models

(one with monthly compounding and another with quarterly compounding) are NOT equivalent.

So, when the solution assumes monthly compounding of monthly deposits, it (the solution)

goes against the way, described in the problem, on how the bank treats this account.

Technically, the computations of PV are incorrect.

The correct calculation is THIS

PV =  = 117,663.42 dollars (without making any intermediate rounding till the end). = 117,663.42 dollars (without making any intermediate rounding till the end).

Compare it with the number of 127,055.64 dollars in the solution by the AI.

The difference is HUGE - - - not acceptable for finance predictions.

But even $117,663.42 is not a correct answer, since it is obtained via wrong conceptual assumption.

The correct solution/answer, adequate to the given problem, is what is given in my solution/post above.

Question 1164749: Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today.

Assume interest of 10 percent per year compounded quarterly.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In this tricky problem, the monthly payments are not compounded.

Monthly payments lie in the bank and wait for the end of a quarter -

only then they are compounded, according to the problem.

So, we actually have quarterly payments of 3*2500 = 7500 dollars each, compounded quarterly.

Thus, it works as an Ordinary Annuity saving plan with quarterly payments of $7500

at the end of each quarter, compounded quarterly at the annual rate of 10%.

60 monthly payments of $2500 each mean 60/3 = 20 quarterly payments of $7500 each.

So, the future value of the account after 20 quarters will be

FV =  = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 = = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 =  .

It gives the solution

X = .

It gives the solution

X =  = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars. = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars.

Solved.

Question 1164954: Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today. Assume interest of 10 percent per year compounded quarterly.

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Determine the present value of a series of 60 monthly payments of $2,500 each which begins 1 month from today.

Assume interest of 10 percent per year compounded quarterly.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In this tricky problem, the monthly payments are not compounded.

Monthly payments lie in the bank and wait for the end of a quarter -

only then they are compounded, according to the problem.

So, we actually have quarterly payments of 3*2500 = 7500 dollars each, compounded quarterly.

Thus, it works as an Ordinary Annuity saving plan with quarterly payments of $7500

at the end of each quarter, compounded quarterly at the annual rate of 10%.

60 monthly payments of $2500 each mean 60/3 = 20 quarterly payments of $7500 each.

So, the future value of the account after 20 quarters will be

FV =  = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 = = 191584.93 dollars.

Now we want to find the present value X. It is the starting value of the account,

which, when compounded quarterly at 10% per year, will have the same future value in 20 quarters.

So, we write this equation

191584.93 =  .

It gives the solution

X = .

It gives the solution

X =  = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars. = 116918.72 dollars.

ANSWER. The present value is $116918.72 dollars.

Solved.

Question 1173636: Kathleen has a $610 loan payment due in eight months. What amount of money should she be able to pay today if the interest on her loan is 3.75% per annum?

Equivalent amount =?

Found 2 solutions by ikleyn, CPhill:

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Kathleen has a $610 loan payment due in eight months. What amount of money

should she be able to pay today if the interest on her loan is 3.75% per annum?

Equivalent amount =?

~~~~~~~~~~~~~~~~~~~~~~~~~~

The problem is worded incorrectly, since it does not define the notion/conception " today " on the timeline.

To be correct, the problem, in traditional formulation, should ask

What amount of money should she pay at the maturity day of the loan ?

As the problem is presented in the post, it makes it clear

to me (and to anyone) that its composer is unprofessional Math writer.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! To find the equivalent amount Kathleen should pay today, we need to calculate the present value of her future loan payment. Here's how:

**Understanding the Concepts**

* **Future Value (FV):** $610 (the amount due in 8 months)

* **Annual Interest Rate (r):** 3.75% or 0.0375

* **Time (t):** 8 months, which is 8/12 of a year

* **Present Value (PV):** The amount to pay today

**Calculations**

Since this is simple interest, we can use the following formula:

* PV = FV / (1 + rt)

Let's plug in the values:

* PV = $610 / (1 + (0.0375 * (8/12)))

* PV = $610 / (1 + (0.0375 * 0.666667))

* PV = $610 / (1 + 0.025)

* PV = $610 / 1.025

* PV ≈ $595.12

**Answer**

Kathleen should be able to pay approximately $595.12 today.

Question 1179080: Grandma decides to put 1300 dollars every month into an account for you. She makes 23 monthly deposits, the last coming September 1, 2003 - the day you start college. She wants you to be able to withdraw money from this account at the beginning of each month, with the first withdrawal coming September 1, 2003 and the last coming June 1, 2008, (when you'll graduate). (Note: that makes 58 withdrawals total.) How much will you be able to withdraw each month if the account is earning a nominal interest rate of 9.3 percent convertible monthly?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Grandma decides to put 1300 dollars every month into an account for you. She makes 23 monthly deposits,

the last coming September 1, 2003 - the day you start college. She wants you to be able to withdraw money

from this account at the beginning of each month, with the first withdrawal coming September 1, 2003

and the last coming June 1, 2008, (when you'll graduate). (Note: that makes 58 withdrawals total.)

How much will you be able to withdraw each month if the account is earning a nominal interest rate

of 9.3 percent convertible monthly?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The problem uses the term " convertible " instead of " compounded ".

This term " convertible " is NEVER USED in this context.

I performed all calculations accurately in a way as it SHOULD be done.

My numbers and my answer are different from that by @CPhill.

Let's break this problem into two parts:

**Part 1: Calculate the Accumulated Value of Grandma's Deposits**

1. **Monthly Deposit:** $1300

2. **Number of Deposits:** 23

3. **Interest Rate:** 9.3% compounded monthly (effective rate r = 0.093/12 per month)

We'll use the future value of an ordinary annuity formula:

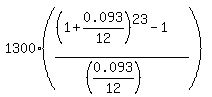

FV =  , (1)

where

* FV = Future Value

* P = Periodic Payment ($1300)

* r = Interest Rate per Period (0.00775)

* n = Number of Periods (23)

FV = , (1)

where

* FV = Future Value

* P = Periodic Payment ($1300)

* r = Interest Rate per Period (0.00775)

* n = Number of Periods (23)

FV =  (2)

I used MS Excel software in my computer.

It is commonly considered as an appropriate tool for such calculations,

since it provides the necessary precision.

I copied and pasted this formula into a MS Excel, and I got the value of $32,592.78.

I did not make intermediate rounding, since intermediate rounding are PROHIBITED

in such calculation: they influence to the final result and lead to wrong answer.

I checked this value using an online calculator at this web-site

https://www.omnicalculator.com/finance/annuity-future-value

https://www.omnicalculator.com/finance/annuity-future-value

I got precisely the same dollars and precisely the same cents.

**Part 2: Calculate the Monthly Withdrawal Amount**

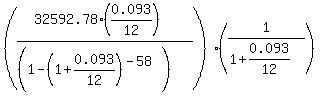

1. **Accumulated Value (Present Value for Withdrawals):** $32592.78

2. **Number of Withdrawals:** 58

3. **Interest Rate:** 9.3% monthly (effective compounding rate r = 0.093/12 per month)

We'll use the present value of an annuity due formula since withdrawals are at the beginning of each month:

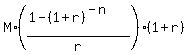

PV = (2)

I used MS Excel software in my computer.

It is commonly considered as an appropriate tool for such calculations,

since it provides the necessary precision.

I copied and pasted this formula into a MS Excel, and I got the value of $32,592.78.

I did not make intermediate rounding, since intermediate rounding are PROHIBITED

in such calculation: they influence to the final result and lead to wrong answer.

I checked this value using an online calculator at this web-site

https://www.omnicalculator.com/finance/annuity-future-value

https://www.omnicalculator.com/finance/annuity-future-value

I got precisely the same dollars and precisely the same cents.

**Part 2: Calculate the Monthly Withdrawal Amount**

1. **Accumulated Value (Present Value for Withdrawals):** $32592.78

2. **Number of Withdrawals:** 58

3. **Interest Rate:** 9.3% monthly (effective compounding rate r = 0.093/12 per month)

We'll use the present value of an annuity due formula since withdrawals are at the beginning of each month:

PV =  , (3)

where:

* PV = Present Value ($32592.78)

* M = Monthly Withdrawal Amount

* r = Interest Rate per Period (0.093/12)

* n = Number of Periods (58)

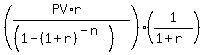

Rearrange the formula (3) to solve for M:

M = , (3)

where:

* PV = Present Value ($32592.78)

* M = Monthly Withdrawal Amount

* r = Interest Rate per Period (0.093/12)

* n = Number of Periods (58)

Rearrange the formula (3) to solve for M:

M =  , (4)

M = , (4)

M =  . (5)

Again, I used MS Excel software in my computer.

It is commonly considered as an appropriate tool for such calculations,

since it provides the necessary precision.

I copied and pasted this formula into a MS Excel, and I got the value of $694.43.

I did not make intermediate rounding, since intermediate rounding are PROHIBITED

in such calculation: they influence to the final result and lead to wrong answer.

Answer. You will be able to withdraw approximately $694.43 at the beginning of each month. . (5)

Again, I used MS Excel software in my computer.

It is commonly considered as an appropriate tool for such calculations,

since it provides the necessary precision.

I copied and pasted this formula into a MS Excel, and I got the value of $694.43.

I did not make intermediate rounding, since intermediate rounding are PROHIBITED

in such calculation: they influence to the final result and lead to wrong answer.

Answer. You will be able to withdraw approximately $694.43 at the beginning of each month.

Solved.

===================================

Dear @CPhill,

I want you do understand me correctly.

After all, in real life it does not matter, if you make a mistake in 10 cents or even in one dollar.

But if you are an " Artificial Intelligence ", you have no right to make a computational mistake even in one cent.

You either use a commonly accepted, trusted, proven computing methodology,

or, as an alternative, NOBODY and NEVER will trust you.

Question 1190654: What is the present value of an ordinary annuity having semi-annual payments of 8,000 pesos for 12 years with an interest rate of 12% compounded annually?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

What is the present value of an ordinary annuity having semi-annual payments of 8,000 pesos

for 12 years with an interest rate of 12% compounded annually?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The solution in the post by @CPhill is INCORRECT.

Indeed, @CPhill introduces " equivalent " scheme with semi-annual compounding,

but in this problem, the bank makes compounding annually - it DOES NOT make compounding semi-annually.

So, the way, which @CPhill treats and solves for this problem is INADEQUATE.

To solve this problem, we should consider annual compounding with annual payments of 2*8000 = 16000 pesos.

Then the formula for the present value is

PV =  = 99109.99 pesos. ANSWER

In this problem, deposits of 8000 pesos, made at the middle of each year, lie in the bank without movement

and wait for the end of the year.

At the end of the year, this money is combined with the deposit made at the end of the year,

and only then the two combined deposits are the subject for compounding. = 99109.99 pesos. ANSWER

In this problem, deposits of 8000 pesos, made at the middle of each year, lie in the bank without movement

and wait for the end of the year.

At the end of the year, this money is combined with the deposit made at the end of the year,

and only then the two combined deposits are the subject for compounding.

Solved correctly.

Question 1190653: How much is the original selling price of shoes being sell by the vendor if Cedric offers to buy it at 1,000 pesos and they agreed at its fair market value of 1,150 pesos?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

How much is the original selling price of shoes being sell by the vendor if Cedric offers

to buy it at 1,000 pesos and they agreed at its fair market value of 1,150 pesos?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

May I ask you - how this collection of words does relate to Math?

Question 1167471: Kenneth ran into some money and decides to invest it for retirement. He has $75,000 to invest over

40 years. Find the effective rates given:

(a) 4.5% growth compounded monthly.

(b) 4.45% growth compounded continuously.

(c) Should Kenneth invest in option (a) or option (b)? Why?

Answer by ikleyn(52781)   (Show Source): (Show Source):

Question 1167985: Darren just got his credit card bill. His payment is due on November 13th. The minimum payment is $25, while his balance is $1396. How much should he pay by November 13th in order to avoid ALL interest and late fees?

Answer by MathLover1(20849)   (Show Source): (Show Source):

Question 1168397: Jimmy went out to lunch 3 times last week and each time he went it cost him $10.58. He went to the movie theaters last week which cost him $15.60 . Jimmy worked at his local grocery store earning a wage of $10 an hour, and worked 30 hours last week. He also bought a new pair of pants for work that cost him $25 last week. What were his total cash outflows for the previous week?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Jimmy went out to lunch 3 times last week and each time he went it cost him $10.58.

He went to the movie theaters last week which cost him $15.60 .

Jimmy worked at his local grocery store earning a wage of $10 an hour, and worked 30 hours last week.

He also bought a new pair of pants for work that cost him $25 last week.

What were his total cash outflows for the previous week?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

D U P L I C A T E

Just solved at this forum under this link

https://www.algebra.com/algebra/homework/word/finance/Money_Word_Problems.faq.question.1168394.html

Question 1168394: Jimmy went out to lunch 3 times last week and each time he went it cost him $10.58. He went to the movie theaters last week which cost him $15.60 . Jimmy worked at his local grocery store earning a wage of $10 an hour, and worked 30 hours last week. He also bought a new pair of pants for work that cost him $25 last week. What were his total cash outflows for the previous week?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

They want you determine the total of the listed outpayments.

To find it, add the numbers 3*10.58, 15.60, 25.

You will get the answer in dollars.

Question 1168448: Jane Windsor financed a $5,900 ski boat with a 12% add-on interest installment loan for 12 months. Given the loan required a 10% down payment, determine the following:

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

Jane Windsor financed a $5,900 ski boat with a 12% add-on interest installment loan for 12 months.

Given the loan required a 10% down payment, determine the following:

~~~~~~~~~~~~~~~~~~~~~~~~

This post/problem is FATALLY DEFECTIVE, since it does not define what to determine.

Extreme degree of inaccuracy.

Question 1168821: 1. Wen Seng operates an ice cream shop. He is trying to decide whether to expand his business to include ice cream cakes. He will need some additional space that will cost him $7,400 per year at the end of each year and some additional equipment that will cost $14,000 up front. The ice cream cakes will provide an extra income of $13,000 per year at the end of each year. The business is expected to last 25 years. The discount rate (or interest rate) for Wen Seng's new business is 6%. What is the Net Present Value of the ice cream cake project? (Assume there are no taxes.)

Thank you so much.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's break down this Net Present Value (NPV) calculation step-by-step.

**1. Calculate the Present Value (PV) of the Costs**

* **Equipment Cost:**

* This is an upfront cost, so its present value is simply $14,000.

* **Space Rental Costs:**

* These are annual costs of $7,400, forming an annuity. We need to find the present value of this annuity.

* PV of annuity = Annual payment * [1 - (1 + r)^-n] / r

* Where:

* Annual payment = $7,400

* r = discount rate = 6% or 0.06

* n = number of years = 25

* PV of space rental = $7,400 * [1 - (1 + 0.06)^-25] / 0.06

* PV of space rental = $7,400 * [1 - (1.06)^-25] / 0.06

* PV of space rental = $7,400 * [1 - 0.23299] / 0.06

* PV of space rental = $7,400 * 0.76701 / 0.06

* PV of space rental = $7,400 * 12.7835

* PV of space rental = $94,597.9

* **Total PV of Costs:**

* Total PV of costs = Equipment cost + PV of space rental

* Total PV of costs = $14,000 + $94,597.9 = $108,597.9

**2. Calculate the Present Value (PV) of the Income**

* **Annual Income:**

* The ice cream cakes will provide an extra income of $13,000 per year, forming an annuity.

* **PV of Income:**

* PV of income = Annual income * [1 - (1 + r)^-n] / r

* Where:

* Annual income = $13,000

* r = discount rate = 6% or 0.06

* n = number of years = 25

* PV of Income = $13,000 * [1 - (1 + 0.06)^-25] / 0.06

* PV of Income = $13,000 * [1 - (1.06)^-25] / 0.06

* PV of Income = $13,000 * [1 - 0.23299] / 0.06

* PV of Income = $13,000 * 0.76701 / 0.06

* PV of Income = $13,000 * 12.7835

* PV of Income = $166,185.5

**3. Calculate the Net Present Value (NPV)**

* NPV = PV of income - PV of costs

* NPV = $166,185.5 - $108,597.9

* NPV = $57,587.6

**Therefore, the Net Present Value of the ice cream cake project is approximately $57,587.60.**

Question 1169070: Barinda is considering running for student government. However, she knows she will

have to work about 10 hours fewer per week if elected, and she makes $7 an hour. The

campaign will also cost her about $100 in campaign buttons and posters. What is her

opportunity cost for serving on student government if elected if she actively serves for 30

weeks?

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! To calculate Barinda's opportunity cost for serving on student government, we need to consider both the income she would forgo due to reduced work hours and the direct expenses of her campaign.

Here's the breakdown:

**1. Income Foregone (Lost Wages):**

* Reduction in work hours per week: 10 hours

* Hourly wage: $7 per hour

* Lost income per week: 10 hours/week \* $7/hour = $70 per week

* Number of weeks of service: 30 weeks

* Total income foregone over 30 weeks: $70/week \* 30 weeks = $2100

**2. Direct Campaign Costs:**

* Cost of campaign buttons and posters: $100

**Calculating the Total Opportunity Cost:**

The opportunity cost is the sum of the value of the next best alternatives that Barinda is giving up to serve on student government. In this case, it's the total income she won't earn due to reduced work hours plus her direct campaign expenses.

Opportunity Cost = Total Income Foregone + Direct Campaign Costs

Opportunity Cost = $2100 + $100

Opportunity Cost = $2200

Therefore, Barinda's opportunity cost for serving on student government if elected for 30 weeks is **$2200**. This represents the total financial value of what she is giving up to take on the role.

Question 1169071: Amber would like to go on the field trip this Saturday. However, she was scheduled to

work 10 hours and she makes $8.50 an hour. Additionally, the field trip activity fee was

$30. What is her opportunity cost to go on the field trip?

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! To determine Amber's opportunity cost of going on the field trip, we need to consider the value of the next best alternative she is giving up. In this case, that involves both the income she would have earned and the direct cost of the field trip.

Here's a breakdown:

* **Income Foregone (Lost Wages):**

* Hours she was scheduled to work: 10 hours

* Hourly wage: $8.50 per hour

* Total income she would have earned: 10 hours * $8.50/hour = $85.00

* **Direct Cost of the Field Trip:**

* Activity fee: $30.00

The opportunity cost is the sum of what she is giving up to go on the field trip. This includes the money she won't earn by not working and the money she has to spend on the field trip itself.

Opportunity Cost = Foregone Income + Direct Cost

Opportunity Cost = $85.00 + $30.00

Opportunity Cost = $115.00

Therefore, Amber's opportunity cost to go on the field trip is **$115.00**. This represents the total value of the next best alternatives she is sacrificing to attend the field trip.

Question 1169073: Graham decided to play football this year instead of getting a part-time job. Last year he

made about $1,100 during football season. He also spends about $9 on eating out after

each game. His team plays a 10-game season. What is his opportunity cost of playing

football?

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! To calculate Graham's opportunity cost of playing football, we need to consider what he is giving up by choosing to play football instead of working.

Here's a breakdown of the costs and benefits:

**Benefits of playing football (that he had last year):**

* **Non-monetary benefits:** These are harder to quantify but could include enjoyment, exercise, social interaction, personal development, etc.

* **Potential monetary benefits this year:** The problem doesn't state he is making money playing football this year, only what he *could* have made at a part-time job.

**Costs of playing football (compared to a part-time job):**

* **Foregone income:** Last year, he made $1,100 during the football season. By playing again instead of working, he is giving up the potential to earn a similar amount (assuming the part-time job would have paid roughly the same).

* **Expenses related to football:** He spends $9 on eating out after each of the 10 games. This totals $9 \times 10 = $90.

**Calculating the Opportunity Cost:**

The opportunity cost is the value of the next best alternative forgone. In this case, it's the sum of what he could have earned and the money he spends directly due to playing football.

Opportunity Cost = Foregone Income + Football-Related Expenses

Opportunity Cost = $1,100 + $90

Opportunity Cost = $1,190

Therefore, Graham's opportunity cost of playing football this year is **$1,190**. This represents the total value of what he is giving up by choosing to play football instead of working a part-time job and accounting for his direct expenses related to playing.

**Important Note:** This calculation only considers the financial aspects mentioned in the problem. The true opportunity cost might also include the value Graham places on the non-monetary benefits of playing football. However, these are subjective and not quantifiable with the information given.

Question 1168937: Suppose that you save for retirement by contributing the same amount each month from your 23rd birthday until your 65th birthday, in an account that pays a steady 5% annual interest compounded monthly.

a) How much will be in your fund at age 65 if you save $ 100 a month?

b) How much will be in your fund if you get a steady return of 7.5% compounded monthly?

c) How much will be in your fund if you get a steady return of 10% compounded monthly? (This is comparable to the average annual return of about 11% for all stocks on the New York Stock Exchange from 1950 to 2000

Answer by ikleyn(52781)   (Show Source): (Show Source):

Question 1169158: Graham decided to play football this year instead of getting a part-time job. Last year he

made about $1,100 during football season. He also spends about $9 on eating out after

each game. His team plays a 10-game season. What is his opportunity cost of playing

football? Can it be solved ASAP

Answer by ikleyn(52781)   (Show Source): (Show Source):

Question 1169160: Amber would like to go on the field trip this Saturday. However, she was scheduled to

work 10 hours and she makes $8.50 an hour. Additionally, the field trip activity fee was

$30. What is her opportunity cost to go on the field trip? Can it be solved ASAP

Found 2 solutions by ikleyn, timofer:

Answer by ikleyn(52781)   (Show Source): (Show Source):

Answer by timofer(104)  (Show Source): (Show Source):

You can put this solution on YOUR website! If she works on the Saturday,  dollars. That's her gross income for working. dollars. That's her gross income for working.

If she attends the field trip instead, then spend $30.

Does that help?

Question 1209975: Maureen opened a savings account and deposited $800.00 as principal. The account earns 5% interest, compounded annually. What is the balance after 6 years?

Use the formula A=P1+

r

n

nt, where A is the balance (final amount), P is the principal (starting amount), r is the interest rate expressed as a decimal, n is the number of times per year that the interest is compounded, and t is the time in years.

Round your answer to the nearest cent.

Answer by ikleyn(52781)   (Show Source): (Show Source):

Question 1169542: i need this for my exam plz help me if you can

Research shows that the demand function for a new product is d(x) = - 5x + 18, where x represents the number of items in thousands and d represents the item price in $.The cost function is C(x) = 2x + 9.

a. State the Revenue function R(x)

b. Find the corresponding Profit function P(x).

c. How many items must be sold to maximize profit?

c. How many items must be sold for the company to break even?

Hint: R(x) = x p(x). The profit function is the difference P(x) = R(x) - C(x).

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Absolutely! Let's solve this problem step-by-step.

Understanding the Problem

We are given the demand function d(x) and the cost function C(x). We need to find the revenue function, profit function, the number of items to maximize profit, and the number of items to break even.

Given Information

Demand function: d(x) = -5x + 18 (price per item)

Cost function: C(x) = 2x + 9

a) Revenue Function R(x)

Revenue is the product of the number of items sold and the price per item.

R(x) = x * d(x)

R(x) = x * (-5x + 18)

R(x) = -5x² + 18x

b) Profit Function P(x)

Profit is the difference between revenue and cost.

P(x) = R(x) - C(x)

P(x) = (-5x² + 18x) - (2x + 9)

P(x) = -5x² + 18x - 2x - 9

P(x) = -5x² + 16x - 9

c) Number of Items to Maximize Profit

To maximize profit, we need to find the vertex of the profit function P(x), which is a quadratic function.

The x-coordinate of the vertex is given by x = -b / (2a), where P(x) = ax² + bx + c.

In our case, a = -5 and b = 16.

x = -16 / (2 * -5) = -16 / -10 = 1.6

Since x represents the number of items in thousands, we need to sell 1.6 * 1000 = 1600 items to maximize profit.

d) Number of Items to Break Even

To break even, the profit must be zero (P(x) = 0).

We need to solve the equation -5x² + 16x - 9 = 0.

We can use the quadratic formula: x = (-b ± √(b² - 4ac)) / (2a)

In our case, a = -5, b = 16, and c = -9.

x = (-16 ± √(16² - 4 * -5 * -9)) / (2 * -5)

x = (-16 ± √(256 - 180)) / -10

x = (-16 ± √76) / -10

x = (-16 ± 8.7178) / -10

x1 = (-16 + 8.7178) / -10 = -7.2822 / -10 = 0.72822

x2 = (-16 - 8.7178) / -10 = -24.7178 / -10 = 2.47178

Since x represents thousands of items, we have:

x1 ≈ 0.72822 * 1000 ≈ 728 items

x2 ≈ 2.47178 * 1000 ≈ 2472 items

Therefore, the company breaks even when selling approximately 728 items or 2472 items.

Final Answers

a) R(x) = -5x² + 18x

b) P(x) = -5x² + 16x - 9

c) 1600 items

d) Approximately 728 items or 2472 items.

Question 1170477: A retirement fund earns 8% compounded quarterly. If Php 400 is deposited every three months for 25 years, the amount in the fund at the end of 25 years is nearest to?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

A retirement fund earns 8% compounded quarterly. If Php 400 is deposited every three months

for 25 years, the amount in the fund at the end of 25 years is nearest to?

~~~~~~~~~~~~~~~~~~~~~~~

Use the formula for the Future value (FV) of an Ordinary Annuity saving plan

FV =  , (1)

P is the quarterly payment (deposit);

r is the quarterly effective rate of compounding, presented as a decimal;

n is the number of deposits (= the number of years multiplied by 4, in this case).

Under the given conditions, P = 400; r = 0.08/4 = 0.02; n = 4*25 = 100.

So, according to the formula (1), the fund will get at the end of the 25-th year

FV = , (1)

P is the quarterly payment (deposit);

r is the quarterly effective rate of compounding, presented as a decimal;

n is the number of deposits (= the number of years multiplied by 4, in this case).

Under the given conditions, P = 400; r = 0.08/4 = 0.02; n = 4*25 = 100.

So, according to the formula (1), the fund will get at the end of the 25-th year

FV =  = $124,892.92. ANSWER = $124,892.92. ANSWER

Solved.

Question 1170479: the officers of a bigh school senior class are planning to rent Buses and vans for a class trip. Each bus can transport 56 students, requires to chaperones, and cost $1200 to rent. Each van can transport eight students, requires one chaperone and cost $120 to rent. Since they are 504 students in the senior class that may be eligible to go on a trip, the opposite of us plan to accommodate at least 504 students. It's only 28 parents having volunteer to serve as chevrons, the officers must plan to use it at most 28 chaperones. How many vehicles of each type should the officers are in order to minimize the transportation cost? What are the minimal transportation cost?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

If to re-write the problem in a correct way, fixing all the deficiencies

of the original text, we will get something like THIS:

the officers of a high school senior class are planning to rent buses and vans for a class trip.

Each bus can transport 56 students, requires two chaperones, and cost $1200 to rent.

Each van can transport eight students, requires one chaperone and cost $120 to rent.

Since there are 504 students in the senior class that may be eligible to go on a trip,

the officers plan to accommodate at least 504 students.

Since only 28 parents having volunteer to serve as chevrons, the officers

must plan to use at most 28 chaperones.

How many vehicles of each type should the officers order to minimize the transportation cost?

What are the minimal transportation cost?

S O L U T I O N

It is a standard linear minimization problem.

Let' solve it using the Linear Programming method.

Let X be the number of buses and Y be the number of vans,

Then from the problem, we have these constraints

56*X + 8*Y => 504, (1)

2*X + 1*Y <= 28, (2)

X >= 0, Y >= 0. (3)

The objective function to minimize is

F(X,Y) = 1200X + 120Y. (4)

We simplify it to this form:

restrictions

7X + Y >= 63 (1')

2X + Y <= 28 (2')

X >= 0, Y >= 0. (3')

Objective function to minimize

F(X,Y) = 1200X + 120Y. (4')

The feasibility domain is the domain in quadrant QI

above or on the line 7X + Y = 63 and below or on the line 2X + Y = 28.

Thus the feasibility domain is the triangle with vertices

P1 = (X,Y) = (9,0) (X-intercept of the line 7X + Y = 63);

P2 = (X,Y) = (14,0) (X-intercept of the line 2X + Y = 28);

P3 = (X,Y) = (7,14) (intersection of the lines 7X + Y = 63 and 2X + Y = 28).

According to the LP-method, the solution point is the corner, where the objective function is minimal.

So, we calculate the objective function F(X,Y) = 1200X + 120Y in three points P1, P2 and P3

P1: F(9,0) = 1200*9 + 120*0 = 10800;

P2: F(14,0) = 1200*14 + 120*0 = 16800;

P3: F(7,14) = 1200*7 + 120*14 = 10080.

The minimum value of the objective function is at P3, so the point P3 = (7,14) provides the optimal solution.

ANSWER. 7 buses and 14 vans provide the optimal solution with the minimum transportation cost of $10,080.

Solved.

Question 1170478: A man is considering the purchase of a used automobile. The total price is $6200. With $1240 as a down payment, and the balance to be paid in 48 equal monthly payments with interest rate at 12% compounded monthly. The payments are due at the end of each month. Determine the monthly payment required.

Answer by ikleyn(52781)   (Show Source): (Show Source):

Question 1170648: Calculate the present value of $5,000 received five years from today if your investments pay

a. 6 percent compounded annually

b. 8 percent compounded annually

c. 10 percent compounded annually

d. 10 percent compounded semiannually

e. 10 percent compounded quarterly

What do your answers to these questions tell you about the relation between present values and interest rates and between present values and the number of compounding periods per year?

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's calculate the present value of $5,000 received five years from today under different compounding scenarios.

**Formula for Present Value (PV):**

PV = FV / (1 + r)^n

Where:

* PV = Present Value

* FV = Future Value ($5,000)

* r = Interest rate per period

* n = Number of periods

**a) 6% Compounded Annually**

* r = 0.06

* n = 5 years

PV = 5000 / (1 + 0.06)^5

PV = 5000 / (1.06)^5

PV = 5000 / 1.3382255776

PV ≈ $3,736.30

**b) 8% Compounded Annually**

* r = 0.08

* n = 5 years

PV = 5000 / (1 + 0.08)^5

PV = 5000 / (1.08)^5

PV = 5000 / 1.4693280768

PV ≈ $3,402.92

**c) 10% Compounded Annually**

* r = 0.10

* n = 5 years

PV = 5000 / (1 + 0.10)^5

PV = 5000 / (1.10)^5

PV = 5000 / 1.61051

PV ≈ $3,104.61

**d) 10% Compounded Semiannually**

* r = 0.10 / 2 = 0.05 (semiannual interest rate)

* n = 5 years * 2 = 10 periods

PV = 5000 / (1 + 0.05)^10

PV = 5000 / (1.05)^10

PV = 5000 / 1.6288946268

PV ≈ $3,069.50

**e) 10% Compounded Quarterly**

* r = 0.10 / 4 = 0.025 (quarterly interest rate)

* n = 5 years * 4 = 20 periods

PV = 5000 / (1 + 0.025)^20

PV = 5000 / (1.025)^20

PV = 5000 / 1.6386164403

PV ≈ $3,051.35

**Observations**

1. **Relation between Present Values and Interest Rates:**

* As the interest rate increases (from 6% to 10%), the present value decreases. This is because a higher interest rate means that money today can grow to a larger amount in the future, so the present value of a future sum is lower.

2. **Relation between Present Values and Compounding Periods:**

* For a given annual interest rate (10% in this case), as the number of compounding periods per year increases (annually, semiannually, quarterly), the present value decreases. This is because more frequent compounding means that the money earns interest on interest more often, making the future value grow faster, and thus requiring a lower present value.

**Summary**

* Higher interest rates lead to lower present values.

* More frequent compounding leads to lower present values.

Question 1170650: Calculate the present value of the following annuity streams:

a. $5,000 received each year for 5 years on the last day of each year if your investments pay 6 percent compounded annually.

b. $5,000 received each quarter for 5 years on the last day of each quarter if your investments pay 6 percent compounded quarterly.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's calculate the present value of these annuity streams.

**a) $5,000 received each year for 5 years at 6% compounded annually.**

This is an ordinary annuity, where payments are made at the end of each period.

* Payment (PMT) = $5,000

* Number of periods (n) = 5 years

* Interest rate per period (r) = 6% or 0.06

The formula for the present value of an ordinary annuity is:

PV = PMT * [1 - (1 + r)^-n] / r

Plugging in the values:

PV = 5000 * [1 - (1 + 0.06)^-5] / 0.06

PV = 5000 * [1 - (1.06)^-5] / 0.06

PV = 5000 * [1 - 0.747258] / 0.06

PV = 5000 * [0.252742] / 0.06

PV = 5000 * 4.21236666667

PV ≈ $21,061.83

**b) $5,000 received each quarter for 5 years at 6% compounded quarterly.**

This is also an ordinary annuity, but with quarterly payments.

* Payment (PMT) = $5,000

* Number of periods (n) = 5 years * 4 quarters/year = 20 quarters

* Interest rate per period (r) = 6% / 4 = 1.5% or 0.015

The formula for the present value of an ordinary annuity is the same:

PV = PMT * [1 - (1 + r)^-n] / r

Plugging in the values:

PV = 5000 * [1 - (1 + 0.015)^-20] / 0.015

PV = 5000 * [1 - (1.015)^-20] / 0.015

PV = 5000 * [1 - 0.742470] / 0.015

PV = 5000 * [0.25753] / 0.015

PV = 5000 * 17.1686666667

PV ≈ $85,843.33

**Answers:**

a. The present value of the annual annuity is approximately $21,061.83.

b. The present value of the quarterly annuity is approximately $85,843.33.

Question 1170652: . Calculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 12 years remaining to maturity, and have a required rate of return of 10 percent.

a. The bond has a 6 percent coupon rate.

b. The bond has a 8 percent coupon rate.

c. The bond has a 10 percent coupon rate.

d. What do your answers to parts

(a) through (c) say about the relation between coupon rates and present values?

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's calculate the fair present values of these bonds.

**Understanding the Concepts**

* **Face Value (FV):** $1,000 (the amount paid at maturity)

* **Years to Maturity:** 12 years

* **Semiannual Payments:** Payments are made twice a year.

* **Required Rate of Return (r):** 10% per year (5% semiannually)

* **Coupon Rate:** The annual interest rate paid on the face value.

* **Coupon Payment (PMT):** (Coupon Rate * Face Value) / 2

**Formulas**

* **Semiannual Required Rate (i):** r / 2

* **Number of Periods (n):** Years to Maturity * 2

* **Present Value (PV) of Bond:**

* PV = (PMT * [1 - (1 + i)^-n] / i) + (FV / (1 + i)^n)

**Calculations**

**a) 6% Coupon Rate**

* Coupon Payment (PMT): (0.06 * $1,000) / 2 = $30

* Semiannual Required Rate (i): 0.10 / 2 = 0.05

* Number of Periods (n): 12 * 2 = 24

* PV = (30 * [1 - (1 + 0.05)^-24] / 0.05) + (1000 / (1 + 0.05)^24)

* PV = (30 * [1 - 0.3094216] / 0.05) + (1000 / 3.225099)

* PV = (30 * 0.6905784 / 0.05) + 310.0695

* PV = (30 * 13.811568) + 310.0695

* PV = 414.34704 + 310.0695

* PV ≈ $724.42

**b) 8% Coupon Rate**

* Coupon Payment (PMT): (0.08 * $1,000) / 2 = $40

* Semiannual Required Rate (i): 0.10 / 2 = 0.05

* Number of Periods (n): 12 * 2 = 24

* PV = (40 * [1 - (1 + 0.05)^-24] / 0.05) + (1000 / (1 + 0.05)^24)

* PV = (40 * [1 - 0.3094216] / 0.05) + (1000 / 3.225099)

* PV = (40 * 0.6905784 / 0.05) + 310.0695

* PV = (40 * 13.811568) + 310.0695

* PV = 552.46272 + 310.0695

* PV ≈ $862.53

**c) 10% Coupon Rate**

* Coupon Payment (PMT): (0.10 * $1,000) / 2 = $50

* Semiannual Required Rate (i): 0.10 / 2 = 0.05

* Number of Periods (n): 12 * 2 = 24

* PV = (50 * [1 - (1 + 0.05)^-24] / 0.05) + (1000 / (1 + 0.05)^24)

* PV = (50 * [1 - 0.3094216] / 0.05) + (1000 / 3.225099)

* PV = (50 * 0.6905784 / 0.05) + 310.0695

* PV = (50 * 13.811568) + 310.0695

* PV = 690.5784 + 310.0695

* PV ≈ $1,000.65

**d) Relation between Coupon Rates and Present Values**

* When the coupon rate is less than the required rate of return (6% and 8%), the bond's present value is less than its face value. This is because the bond pays less interest than what the market demands.

* When the coupon rate is equal to the required rate of return (10%), the bond's present value is approximately equal to its face value.

* In essence, the higher the coupon rate relative to the required rate of return, the higher the present value of the bond. Conversely, the lower the coupon rate, the lower the present value.

Question 1209929: The Pireras are planning to go to Europe 4 years from now and have agreed to set aside $180/month for their trip. If they deposit this money at the en each month into a savings account paying interest at the rate of 3%/year compounded monthly, how much money will be in their ‘travel fund at the end of the fourth year? (Round your answer to the nearest cent.)

Found 2 solutions by ikleyn, CPhill:

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

As it often happens with such calculations, the answer in the post by @CPhill is not accurate.

An accurate answer is $9167.62, obtained using MS Excel with 15 decimals and without making intermediate rounding.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's break down this problem step by step.

**1. Understand the Problem**

* This is a future value of an ordinary annuity problem.

* The Pireras deposit $180 at the end of each month.

* The interest rate is 3% per year, compounded monthly.

* The time period is 4 years.

**2. Identify the Variables**

* Monthly payment (PMT) = $180

* Annual interest rate (r) = 3% = 0.03

* Monthly interest rate (i) = r / 12 = 0.03 / 12 = 0.0025

* Number of years (t) = 4

* Number of payments (n) = t * 12 = 4 * 12 = 48

**3. Apply the Future Value of an Ordinary Annuity Formula**

The formula is:

FV = PMT * [((1 + i)^n - 1) / i]

Where:

* FV = Future Value

* PMT = Monthly Payment

* i = Monthly Interest Rate

* n = Number of Payments

**4. Calculate the Future Value**

FV = 180 * [((1 + 0.0025)^48 - 1) / 0.0025]

FV = 180 * [((1.0025)^48 - 1) / 0.0025]

Let's calculate (1.0025)^48 first:

(1.0025)^48 ≈ 1.1273383

Now, plug that into the formula:

FV = 180 * [(1.1273383 - 1) / 0.0025]

FV = 180 * [0.1273383 / 0.0025]

FV = 180 * 50.93532

FV ≈ 9168.3576

**5. Round to the Nearest Cent**

FV ≈ $9168.36

**Answer:** The Pireras will have approximately $9168.36 in their travel fund at the end of the fourth year.

Question 1171213: Cricket World Cup (CWC) is considering a project proposal which requires an initial investment of $72,625 and it is expected to have net cash flows of $15,000 per year for 8 years. The firm cash flows are discounted at a rate of 12 percent.

a. What is the project’s Net Present Value (NPV)? (Rounded to 2 decimal places)

b. What is the project’s discounted payback period? (Rounded to 2 decimal places)

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Absolutely! Let's calculate the NPV and discounted payback period for the CWC project proposal.

**a) Net Present Value (NPV)**

To find the NPV, we need to discount each year's cash flow back to its present value and then sum them up, subtracting the initial investment.

* **Year 0 (Initial Investment):** -$72,625

* **Years 1-8 (Annual Cash Flows):** $15,000 per year

We use the present value formula: PV = CF / (1 + r)^n

Where:

* PV = Present Value

* CF = Cash Flow

* r = Discount Rate (12% or 0.12)

* n = Year

Let's do the calculations:

* **Year 1:** $15,000 / (1.12)^1 = $13,392.86

* **Year 2:** $15,000 / (1.12)^2 = $11,957.91

* **Year 3:** $15,000 / (1.12)^3 = $10,676.71

* **Year 4:** $15,000 / (1.12)^4 = $9,532.78

* **Year 5:** $15,000 / (1.12)^5 = $8,511.41

* **Year 6:** $15,000 / (1.12)^6 = $7,599.47

* **Year 7:** $15,000 / (1.12)^7 = $6,785.24

* **Year 8:** $15,000 / (1.12)^8 = $6,058.25

Now, sum these present values and subtract the initial investment:

NPV = -$72,625 + $13,392.86 + $11,957.91 + $10,676.71 + $9,532.78 + $8,511.41 + $7,599.47 + $6,785.24 + $6,058.25 = $1,889.63

Therefore, the NPV is approximately $1,889.63.

**b) Discounted Payback Period**

The discounted payback period is the time it takes for the discounted cash flows to recover the initial investment.

1. **Year 0:** -$72,625

2. **Year 1:** -$72,625 + $13,392.86 = -$59,232.14

3. **Year 2:** -$59,232.14 + $11,957.91 = -$47,274.23

4. **Year 3:** -$47,274.23 + $10,676.71 = -$36,597.52

5. **Year 4:** -$36,597.52 + $9,532.78 = -$27,064.74

6. **Year 5:** -$27,064.74 + $8,511.41 = -$18,553.33

7. **Year 6:** -$18,553.33 + $7,599.47 = -$10,953.86

8. **Year 7:** -$10,953.86 + $6,785.24 = -$4,168.62

9. **Year 8:** -$4,168.62 + $6,058.25 = $1,889.63

From the above calculations, we see that the discounted payback occurs in year 8.

Therefore:

* **a) NPV:** $1,889.63

* **b) Discounted Payback Period:** 8 years.

Question 1171401: Deion bought a tent that was marked down 50% from an original price of $40. If he paid 5% sales tax, what was the total cost of the tent?

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

After the discount, the selling price of the tent was 0.5*40 = 20 dollars.

5% tax of 20 dollars is 0.05*20 = 0.5*2 = 1 dollar.

Hence, Deion paid 20 + 1 = 21 dollars to cashier.

Question 1171791: a predator requires 21 units of food A 12 units of food B, and 21 units of food C as its average daily consumption. these requirements are satisfied by feeling on two prey species. one prey of species A, provides 6,2 and 3 units of food of A,B, and C, respectively. to capture and digest a prey of species B provides 3,3 and 5 units of A, B and C, respectively. to capture and digest a prey of species A requires 7 units of energy, on the average. the corresponding energy. How many preys of each should the predator capture to meet its food requirement with minimum expenditure? find the objective function, constraints and max/min value.

Found 2 solutions by ikleyn, CPhill:

Answer by ikleyn(52781)   (Show Source): (Show Source):

You can put this solution on YOUR website! .

a predator requires 21 units of food A 12 units of food B, and 21 units of food C as its average daily consumption.

these requirements are satisfied by feeling on two prey species.

one prey of species A, provides 6,2 and 3 units of food of A,B, and C, respectively.

to capture and digest a prey of species B provides 3,3 and 5 units of A, B and C, respectively.

to capture and digest a prey of species A requires 7 units of energy, on the average.

the corresponding energy.

How many preys of each should the predator capture to meet its food requirement with minimum expenditure?

find the objective function, constraints and max/min value.

~~~~~~~~~~~~~~~~~~~~~~~~~

Regarding this "problem" in the post, I have several notices.

(1) The meaning of the post is unclear. The species are mixed with food (go under the same names).

It turns the problem into the soup of words.

Undoubtedly, it is IMPOSSIBLE to consider such a text as a Math problem.

(2) How @CPhill interprets it - - - it does not matter.

If the problem's meaning is unclear from its text, interpretations will not help.

(3) In his post, @CPhill writes for the energy function to minimize

Z = 7x + 5y.

In the text, NOTHING does point to this formula.

So, it makes the solution by @CPhill IRRELEVANT.

(4) In the solution, @CPhill proposes to make a lot of unnecessary job calculating the objective

function in corner points that do not belong to the feasibility domain.

The CONCLUSIONS:

The text in the post CAN NOT be interpreted as a Math problem.

This "problem's" right place is in the garbage bin.

Interpretation by @CPhill is not adequate and is not relevant to the problem.

The solution in the post by @CPhill is WRONG WAY TEACHING.

For the safety of you mind, simply ignore the problem and the post by @CPhill.

* * * * DO NOT CONSIDER THIS GIBBERISH seriously. * * * *

\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\

Regarding the post by @CPhill . . .

Keep in mind that @CPhill is a pseudonym for the Google artificial intelligence.

The artificial intelligence is like a baby now. It is in the experimental stage

of development and can make mistakes and produce nonsense without any embarrassment.

It has no feeling of shame - it is shameless.

This time, again, it made an error.

Although the @CPhill' solution are copy-paste Google AI solutions, there is one essential difference.

Every time, Google AI makes a note at the end of its solutions that Google AI is experimental

and can make errors/mistakes.

All @CPhill' solutions are copy-paste of Google AI solutions, with one difference:

@PChill never makes this notice and never says that his solutions are copy-past that of Google.

So, he NEVER SAYS TRUTH.

Every time, @CPhill embarrassed to tell the truth.

But I am not embarrassing to tell the truth, as it is my duty at this forum.

And the last my comment.

When you obtain such posts from @CPhill, remember, that NOBODY is responsible for their correctness,

until the specialists and experts will check and confirm their correctness.

Without it, their reliability is ZERO and their creadability is ZERO, too.

Plus one comment specially for the developers of this AI.

The most weak feature of your current development is that this current AI

is unable to recognize idiotic "problems" and to distinct them from regular Math problems.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's break down this problem step-by-step to formulate it as a linear programming problem and find the solution.

**1. Define Variables**

* Let `x` be the number of prey of species A captured.

* Let `y` be the number of prey of species B captured.

**2. Formulate the Objective Function**

* The objective is to minimize the energy expenditure.

* Energy cost for species A: 7 units per prey

* Energy cost for species B: 5 units per prey

* Objective function (minimize energy): `Z = 7x + 5y`

**3. Formulate the Constraints**

* **Food A:** 6x + 3y ≥ 21

* **Food B:** 2x + 3y ≥ 12

* **Food C:** 3x + 5y ≥ 21

* **Non-negativity:** x ≥ 0, y ≥ 0 (You can't have negative prey)

**4. Solve the Linear Programming Problem**

We'll use a graphical method to find the feasible region and the optimal solution.

* **Graph the Constraints:**

* 6x + 3y = 21 (or 2x + y = 7)

* 2x + 3y = 12

* 3x + 5y = 21

* **Find the Intersection Points:**

* Intersection of 2x + y = 7 and 2x + 3y = 12:

* Subtract the first equation from the second: 2y = 5, y = 2.5

* Substitute y = 2.5 into 2x + y = 7: 2x + 2.5 = 7, 2x = 4.5, x = 2.25

* (2.25, 2.5)

* Intersection of 2x + y = 7 and 3x + 5y = 21

* multiply 2x+y=7 by 5. 10x+5y=35

* subtract 3x+5y=21. 7x = 14 x=2

* 2(2)+y=7. y=3

* (2,3)

* Intersection of 2x + 3y = 12 and 3x + 5y = 21

* multiply 2x+3y=12 by 3. 6x+9y=36

* multiply 3x+5y=21 by 2. 6x+10y=42

* subtract 6x+9y=36 from 6x+10y=42. y=6

* 2x+3(6)=12 2x=-6 x=-3. This is not in the feasible region.

* **Find the Corner Points of the Feasible Region:**

* (0, 7) (from 2x+y=7)

* (6,0) (from 2x+3y=12)

* (7,0) (from 3x+5y=21)

* (0,4) (from 2x+3y=12)

* (0,4.2) (from 3x+5y=21)

* (2.25,2.5)

* (2,3)

* **Evaluate the Objective Function at Each Corner Point:**

* Z(0, 7) = 7(0) + 5(7) = 35

* Z(6, 0) = 7(6) + 5(0) = 42

* Z(7, 0) = 7(7) + 5(0) = 49

* Z(0, 4.2) = 7(0) + 5(4.2) = 21

* Z(2.25, 2.5) = 7(2.25) + 5(2.5) = 15.75 + 12.5 = 28.25

* Z(2, 3) = 7(2) + 5(3) = 14 + 15 = 29

* **Determine the Minimum Value:**

* The minimum value of Z is 28.25 at (2.25, 2.5). However, since we can't have fractional prey, we need to examine the integer points surrounding (2.25,2.5). Those points are (2,3) and (3,2).

* Z(2,3) = 29

* Z(3,2) = 7(3)+5(2) = 21+10=31

* The minimum integer value is 29 at (2,3).

**Results**

* **Objective Function:** Z = 7x + 5y (minimize energy)

* **Constraints:**

* 6x + 3y ≥ 21

* 2x + 3y ≥ 12

* 3x + 5y ≥ 21

* x ≥ 0, y ≥ 0

* **Minimum Value:** 29

* **Solution:** The predator should capture 2 prey of species A and 3 prey of species B.

Question 1171817: You are considering three invest¬ments. The first is a bond that is selling in the market at RM1,200. The bond has a RM 1,000 par value, pays interest at 14 percent, and is scheduled to mature in 12 years. For bonds of this risk class you believe that a 12 percent rate of return should be required. The second investment that you are analyzing is a preferred stock (RM100 par value) that sells for RM80 and pays an annual dividend of RM 12. Your required rate of return for this stock is 14 percent. The last investment is a common stock (RM35 par value) that recently paid a RM3 dividend. The firm’s earnings per share have increased from RM4 to RM8 in 10 years, which also reflects the expected growth in dividends per share for the indefinite future. The stock is selling for RM25, and you think a reasonable required rate of return for the stock is 20 percent.

a. Calculate the value of each security based on your required rate of return.

b. Which investment(s) should you accept? Why?

c. 1. If your required rates of return changed to 14 percent for the bond, 16 percent for the preferred stock, and 18 percent for the common stock, how would your answers change to parts (a) and (b)?

2. Assuming again that your required rate of return for the common stock is 20 percent, but the anticipated growth rate changes to 12 percent, would your answers to parts (a) and (b) be different

d. Explain the relationship between an investor’s required rate of return and the value of a security.

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Absolutely! Let's break down each investment scenario step-by-step.

**a. Calculate the Value of Each Security Based on Your Required Rate of Return**

**1. Bond Valuation**

* **Par Value (FV):** RM 1,000

* **Coupon Rate:** 14% of RM 1,000 = RM 140 per year

* **Market Price:** RM 1,200

* **Years to Maturity (n):** 12

* **Required Rate of Return (r):** 12% = 0.12

We need to calculate the present value of the bond's cash flows (coupon payments and par value) using the required rate of return.

* **Present Value of Coupon Payments (Annuity):**

* PV = C * [1 - (1 + r)^-n] / r

* PV = 140 * [1 - (1 + 0.12)^-12] / 0.12

* PV = 140 * [1 - (1.12)^-12] / 0.12

* PV = 140 * [1 - 0.25596] / 0.12

* PV = 140 * 0.74404 / 0.12

* PV ≈ RM 868.05

* **Present Value of Par Value:**

* PV = FV / (1 + r)^n

* PV = 1000 / (1.12)^12

* PV = 1000 / 3.89597599

* PV ≈ RM 256.68

* **Total Bond Value:**

* Bond Value = PV of Coupon Payments + PV of Par Value

* Bond Value = 868.05 + 256.68

* Bond Value ≈ RM 1,124.73

**2. Preferred Stock Valuation**

* **Annual Dividend (D):** RM 12

* **Market Price:** RM 80

* **Required Rate of Return (r):** 14% = 0.14

* **Preferred Stock Value:**

* Value = D / r

* Value = 12 / 0.14

* Value ≈ RM 85.71

**3. Common Stock Valuation**

* **Current Dividend (D0):** RM 3

* **Current Stock Price:** RM 25

* **Required Rate of Return (r):** 20% = 0.20

* **Growth Rate (g):**

* Earnings per share increased from RM 4 to RM 8 in 10 years.

* 8 = 4(1+g)^10

* 2 = (1+g)^10

* 1.07177 = 1+g

* g = 0.07177 or 7.177%

* We will use the Gordon Growth model:

* Value = D1 / (r - g)

* D1 = D0 * (1 + g) = 3 * (1.07177) = 3.21531

* Value = 3.21531 / (0.20 - 0.07177)

* Value = 3.21531 / 0.12823

* Value ≈ RM 25.07

**b. Which Investment(s) Should You Accept? Why?**

* **Bond:**

* Calculated Value: RM 1,124.73

* Market Price: RM 1,200

* **Decision:** Do not accept. The market price is higher than your calculated value.

* **Preferred Stock:**

* Calculated Value: RM 85.71

* Market Price: RM 80

* **Decision:** Accept. The calculated value is higher than the market price.

* **Common Stock:**

* Calculated Value: RM 25.07

* Market Price: RM 25

* **Decision:** Accept. The calculated value is higher than or very close to the market price.

**c. Changes in Required Rates of Return and Growth Rate**

**1. Changed Required Rates of Return**

* **Bond (14%):**

* PV coupon = 140 * [1-(1.14^-12)]/0.14 = 721.28

* PV Par = 1000/1.14^12 = 207.56

* Bond Value = 721.28 + 207.56 = 928.84. Do not Accept.

* **Preferred Stock (16%):**

* Value = 12 / 0.16 = RM 75. Do not accept.

* **Common Stock (18%):**

* Value = 3.21531 / (0.18 - 0.07177) = 29.89. Accept.

**2. Changed Growth Rate (12% Common Stock)**

* **Growth Rate (g):** 12% = 0.12

* **D1:** 3 * 1.12 = 3.36

* Value = 3.36 / (0.20 - 0.12) = 3.36 / 0.08 = 42. Accept.

**d. Relationship Between Required Rate of Return and Security Value**

* There is an inverse relationship between an investor's required rate of return and the value of a security.

* When the required rate of return increases, the present value of future cash flows decreases, leading to a lower security value.

* Conversely, when the required rate of return decreases, the present value of future cash flows increases, resulting in a higher security value.

* Essentially, a higher required return means the investor demands a larger discount rate applied to future cash flows, reducing their present value.

Question 1209843: How long do you need to invest your money in an account earning an annual interest rate of 5,624% compounded daily so that your investment grows from $1380.96 to $10369 over that period of time? give answer in days

Found 2 solutions by ikleyn, CPhill:

Answer by ikleyn(52781)   (Show Source): (Show Source):

Answer by CPhill(1959)   (Show Source): (Show Source):

You can put this solution on YOUR website! Let's break down how to calculate the investment time.

**Understanding the Problem**

* We have an initial investment (principal) of $1380.96.

* We want the investment to grow to $10369.

* The annual interest rate is 5,624% (which is 56.24 as a decimal), compounded daily.

**Using the Compound Interest Formula**

The formula for compound interest is:

A = P (1 + r/n)^(nt)

Where:

* A = the future value of the investment/loan, including interest

* P = the principal investment amount (the initial deposit or loan amount)

* r = the annual interest rate (decimal)

* n = the number of times that interest is compounded per year

* t = the number of years the money is invested or borrowed for

In this case:

* A = $10369

* P = $1380.96

* r = 56.24

* n = 365 (compounded daily)

* t = ?

We need to solve for t.

1. **Rearrange the formula to solve for t:**

* t = log(A/P) / (n * log(1 + r/n))

2. **Plug in the values:**

* t = log(10369 / 1380.96) / (365 * log(1 + 56.24 / 365))

3. **Calculate the result:**

* t ≈ 35.85 years

4. **Convert years to days:**

* 35.85 years * 365 days/year ≈ 13085 days

**Answer**

You would need to invest your money for approximately 13085 days.