for a 12 year loan, there are 24 semi-annual payments of 2100, made at the end of each semi-annual time period.

using the ti-business analyst 2 calculator, i get a semi-annual interest rate of 4.160152395%-

divide that by 100 and then add 1 to it to get a semi-annual growth factor of 1.04160152395.

raise that to the second power to get an effective annual growth factor of 1.084933735.

take the fourth root of that to get an effective quarterly growth factor of 1.020588812.

subtract 1 from that and then multiply it by 400 to get a nominal annual growth rate of 8.035524952%.

that should be your answer.

to see if this makes sense, do the following.

assume the nominal interest rate is what you just derived, meaning it is equal to 8.035524952%.

to find the quarterly interest rate, divide that by 4 to get 2.058881238%.

to convert that to a quarterly growth factor, divide it by 100 and then add 1 to it to get 1.02058881238.

raise that to the second power to get an effective semi-annual growth factor of 1.041601524.

subtract 1 from that and then multiply it by 100 to get 4.1601524%.

that's the same semi-annual interest rate that i got using the financial calculator, indicating that the quarterly growth factor is correct.

i'm reasonably sure that this is correct.

your solution should be a nominal annual interest rate of 8.035524952%. which is equal to 8.0355% when rounded to 4 decimal places which is equal to 8.04% when rounded to 2 decimal places.

the financial calculator at can be used to find the semi-annual interest rate.

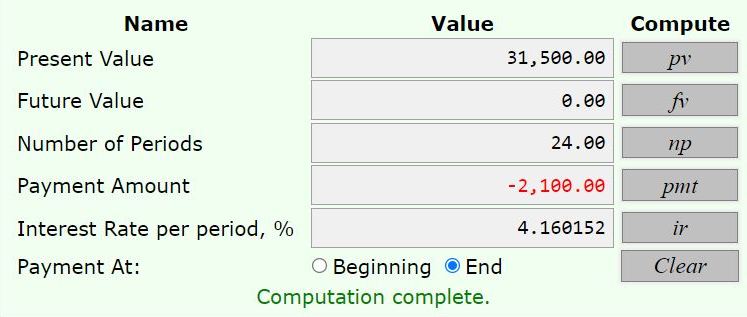

the result of that analysis is shown below:

the inputs were:

present value = 31500

future value = 0

number of time periods = 12 years * 2 time periods per year = 24 semi-annual time periods.

the payments at the end of each time period are 2100, shown as -2100 because they are money going out.

click on interest rate % per time period and you get 4.160152%.

this agrees with that i got using the ti-business analyst 2 calculator, when rounding is taken into consideration.