SOLUTION: Your Credit card has a balance of $5200 and an annual interest rate of 12%. You decide to pay off the balance over 3 years. If there are no further purchases charged to the card, y

Algebra.Com

Question 1135034: Your Credit card has a balance of $5200 and an annual interest rate of 12%. You decide to pay off the balance over 3 years. If there are no further purchases charged to the card, you must pay $172.71 each month, and you will pay a total interest of $1017.56. Assume you decide to pay off the balance over 1 year rather than 3.

How much more must you pay each month?

How much less will you pay in total interest?

Answer by Theo(13342) (Show Source): You can put this solution on YOUR website!

use of a financial calculator will help to answer this question.

an online calculator you can use can be found at https://arachnoid.com/finance/

the interest rate is 12% per year compounded monthly = 1% per month.

the number of months of the original loan is 3 years * 12 = 36 months.

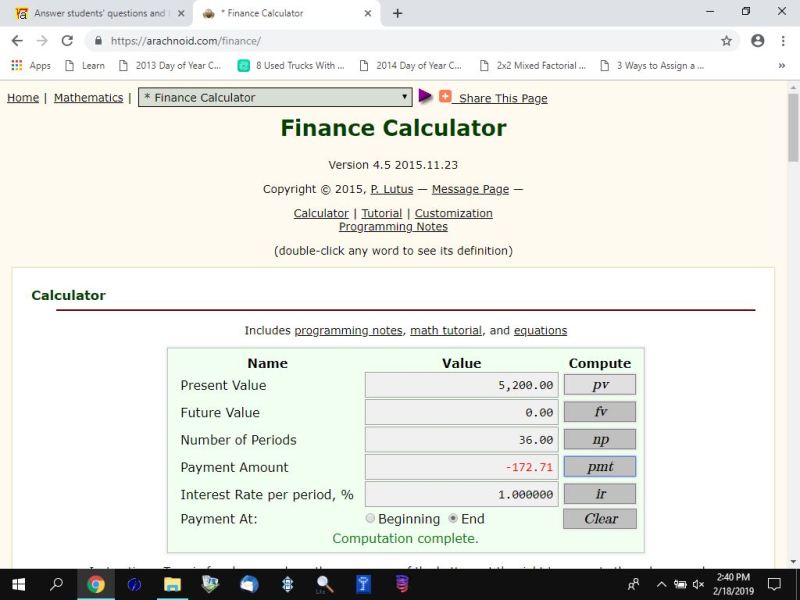

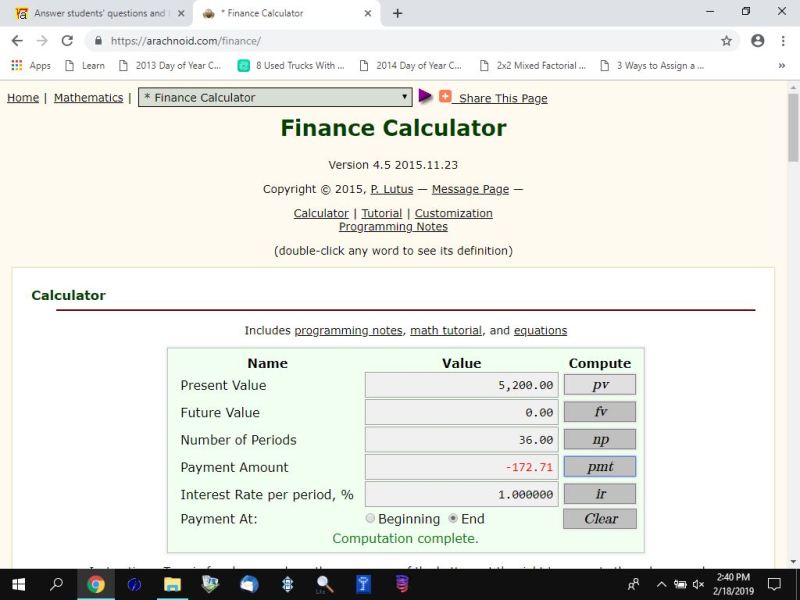

you can confirm the payments each month and the total interest charged is correct by doing the following.

provide the following values to the values to the calculator.

present value = 5200

future value = 0

number of periods = 36

interest rate per period = 1

payments made at the end of each period.

click on PMT and the calculator tells you that the monthly payment needs to be 172.71

the total interest charged is found by multiplying the monthly payment by 36 and then subtracting the present value of the loan from that.

you will get 172.71 * 36 minus 5200 = 1017.56.

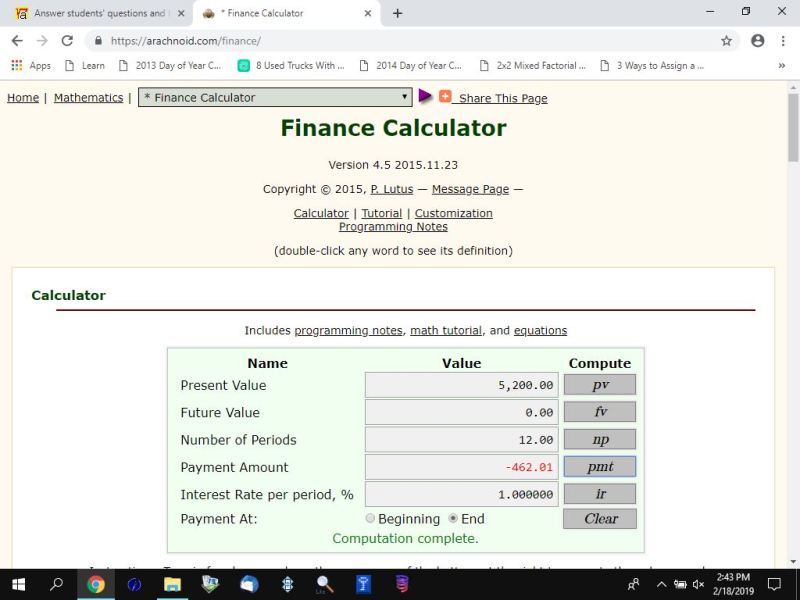

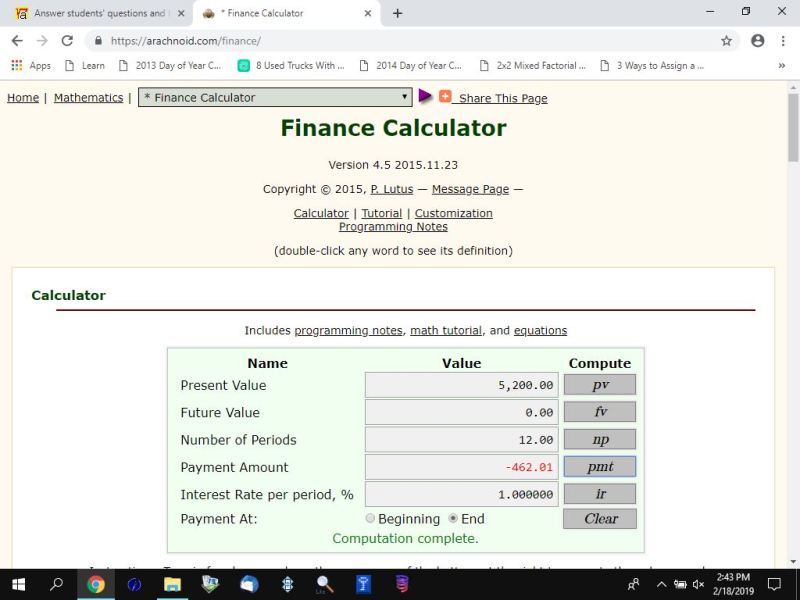

if you want to pay the balance off in 1 year instead of 3, you would go back to the calculator and change the number of months from 36 to 12 and then have the calculator tell you what the monthly payment needs to be.

the calculator will tell you that the monthly payments will need to be 462.01.

the total interest will be 462.01 * 12 minus 5200 = 344.12.

you must pay 462.01 minus 172.71 = 289.3 more per month.

your total interest will be 1017.56 minus 344.12 = 673.44 less.

here's the results from using the online financial calculator.

the payments are shown as negative because it's money going out.

the calculator requires the signs be opposed.

if the present value is negative, the payment must be positive.

if the present value is positive, the payment must be negative.

it's just the way the calculator works.

most financial calculators work that way.

RELATED QUESTIONS

your credit card has a balance of $3600 and an annual interest rate of 16.5%. you decide... (answered by lynnlo)

Your credit card has a balance of β$6100 and an annual interest rate of 19β%. You... (answered by Theo)

Your credit card has a balance of $6100.00 and an annula interest rate of 12%.

You... (answered by Theo)

Your credit card has a balance of β$3100 and an annual interest rate of 12β%. You... (answered by math_tutor2020)

You decide to quit using your credit card and want to pay off the balance of $3,000 in 2... (answered by Theo)

Its time to go shopping! You grab your Best Purchase credit card, which has an annual... (answered by solver91311)

A credit card balance is $3500. The interest rate is 18%. The balance is paid off,... (answered by greenestamps)

The annual interest rate on a credit card is 13.99%. If the minimum payment of $20 is... (answered by pphantom)

How many months will it atke to pay off a credit card with a balance of of $1000 if you... (answered by ewatrrr)