the low rate is 4.64% per year.

the mortgage amount is 100,000

the length of the mortgage is 30 years.

assuming the $753.33 is the amount that we can use to pay off the mortgage, then the following applies, when using the following calculator.

https://arachnoid.com/finance/

a payment of $753.33 at the end of each month for 30 years at 14.75% interest rate per year will be able to service a mortgage of 60,533.91.

here's a picture of the calculations.

the inputs are everything except the present value.

the output is the present value.

the interest rate is 14.75% / 12 = 1.229167% per month.

the number of time periods is 30 * 12 = 360 months.

a payment of $753.33 at the end of each month for 30 years at 4.64% interest rate per year will be able to service a mortgage of $146,266.98.

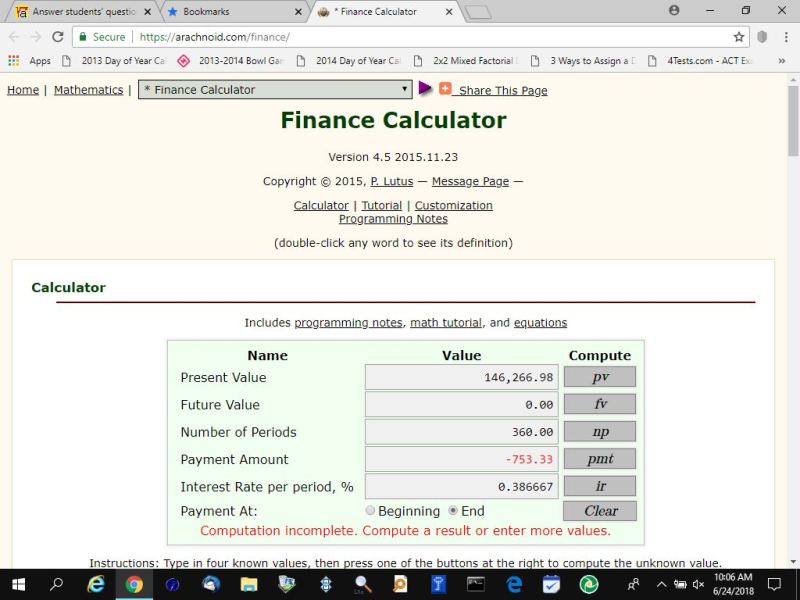

here's a picture of the calculations.

the inputs are everything except the present value.

the output is the present value.

the interest rate is 4.64% / 12 = .386667% per month.

the number of time periods is 30 * 12 = 360 months.

at 14.75% per year, we could not afford to pay the mortgage.

at 4.64% per year, we could easily afford to pay the mortgage.

the maximum interest rate per year that would allow us to pay off the $100,000 mortgage with payments of $753.33 at the end of each month, would be .689945% per month * 12 = 8.27934% per year.

here's a picture of the calculations.

the inputs are everything except the interest rate percent.

the output is the interest rate percent per month.

the interest rate per month is multiplied by 12 to get the interest rate per year.

the number of time periods is 30 * 12 = 360 months.